Authier Lithium Project Due Diligence Advanced

Brisbane, June 14, 2016 AEST (ABN Newswire) - Sayona Mining Limited ( ASX:SYA) ("Sayona" or the "Company") is pleased to announce that due diligence on the proposed Authier lithium project acquisition in Canada is nearing completion.

ASX:SYA) ("Sayona" or the "Company") is pleased to announce that due diligence on the proposed Authier lithium project acquisition in Canada is nearing completion.

The Company is actively working through a due diligence program covering all the legal and technical aspects of the proposed acqusition. The Company has commissioned independent assessments, including:

- Resources - an independent Competent Person has visited the Authier lithium project, completed a geological and historical drilling data review, and will shortly release a JORC Mineral Resource estimate;

- Technical and economic - SGS Canada Inc and Burnigeme Inc have completed an economic assessment, including updating all the mine, processing, administration operating and capital cost estimates previously disclosed in the Glen Eagle Resources 2013 NI-43101. In addition, SGS completed Whittle pit optimisations using the new operating and capital cost estimates, and revised spodumene concentrate pricing and exchange rate assumptions; and

- Legal - a review to confirm the tenure is in good standing and there are no major environmental or cultural issues that will affect a potential project development.

The Company has also commenced preliminary discussions with prospective financiers in regard to funding the acquisition, and has been encouraged by the response regarding the level and types of funding that could be available. Financing will be completed once all shareholder and regulatory approvals are completed.

The key attractions of the Authier lithium project acquisition, include:

- Extensively drilled - mineralisation hosted in a spodumene-bearing pegmatite intrusion with more than 15,000 metres of drilling in 123 holes;

- Simple deposit - 825 metres long with an average thickness of 25 metres dipping at 40 degrees, amenable to low-cost, open-cut mining techniques;

- Defined resources - foreign measured and indicated resources totalling 74,000 tonnes of contained Li20, with demonstrated economic viability. Additional inferred resources total 14,899 tonnes Li20 - see Appendix A (in link below) for details and cautionary statement;

- Simple metallurgy - extensive metallurgical testing and flowsheet designed to produce a 5-6% Li20 concentrate at an 85% metallurgical recovery;

- Well studied - a NI43-101 Technical Report - Preliminary Economic Assessment - completed in 2013, demonstrated the technical and commercial viability of developing the deposit, and selling lithium concentrates;

- Excellent infrastructure - situated 45 kilometres from mining support services, and links to road and rail networks, including the Quebec export port; and

- Large sunk cost - significant investment in drilling, geophysics and development studies.

The Company's strategy at the completion of the transaction, includes:

- Exploration and further drilling to target expanding the existing mineral resources;

- Identifying other resources in the tenement package and in the surrounding district to potentially expand the scale of the project; and

- Studying options for improving the project economics including, metallurgical optimisation and downstream processing options.

Transaction Value Proposition

The Company believes the acquisition of Authier represents an excellent opportunity to create value-uplift potential for shareholders as the project is advanced towards development.

Key attractions of the acquisition, include:

- Large sunk cost in terms of exploration, drilling, metallurgical testing, and other economic studies;

- The price outlook for lithium is very strong. Lithium is a high-value product which is anticipated to be in tight supply as the demand for lithium-ion batteries continues to experience transformational growth due to use in the new green technology sectors;

- The Company will be less exposed to the outcomes of early-stage exploration with a defined Mineral Resource estimate;

- When benchmarked by market capitalisation, there is significant value-uplift potential for the Company when compared to the Australian Securities Exchange ("ASX") listed lithium explorers and producers - see Figure 1 below; and

- The Company is acquiring Authier at a very attractive enterprise value of $44 per tonne of contained lithium resources when compared to the enterprise values per tonne of contained lithium of the ASX peer group companies.

The Company believes the acquisition of Authier represents an excellent fit with the Company's capabilities and strategy of sourcing the raw materials required to produce lithium-ion batteries. Authier is a near-term development project and cashflow generation opportunity, being acquired at a very attractive valuation. The Company believes it will create significant share value-uplift potential for shareholders as the project is advanced towards development.

To view tables, figures and Appendix A, please visit:

http://abnnewswire.net/lnk/8DRJ87RF

About Sayona Mining Limited

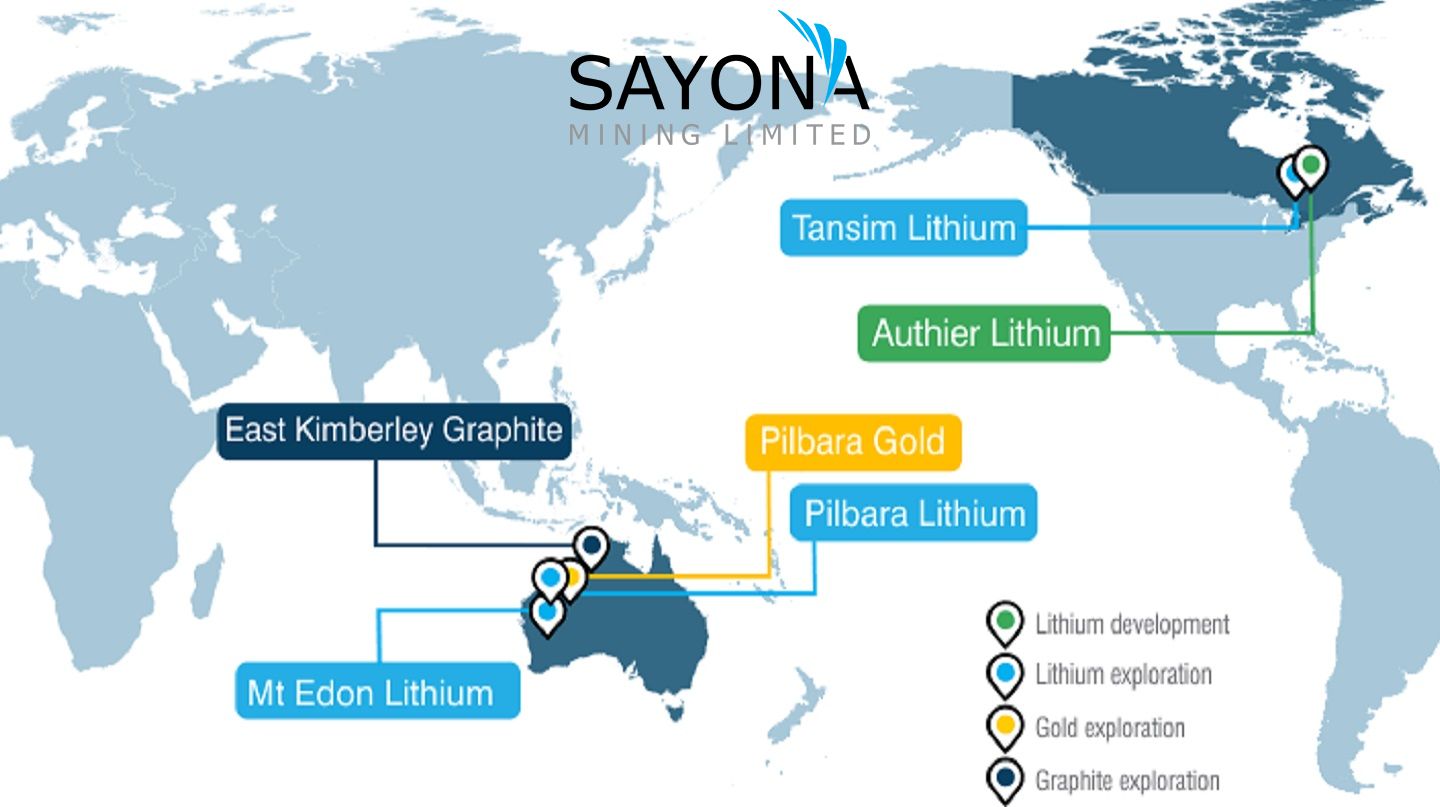

Sayona Mining Limited (ASX:SYA) (OTCMKTS:SYAXF) is a North American lithium producer with projects in Quebec, Canada and Western Australia. In Quebec, Sayona's assets comprise North American Lithium together with the Authier Lithium Project and its emerging Tansim Lithium Project, supported by a strategic partnership with American lithium developer Piedmont Lithium Inc. (ASX:PLL). Sayona also holds a 60% stake in the Moblan Lithium Project in northern Quebec.

Sayona Mining Limited (ASX:SYA) (OTCMKTS:SYAXF) is a North American lithium producer with projects in Quebec, Canada and Western Australia. In Quebec, Sayona's assets comprise North American Lithium together with the Authier Lithium Project and its emerging Tansim Lithium Project, supported by a strategic partnership with American lithium developer Piedmont Lithium Inc. (ASX:PLL). Sayona also holds a 60% stake in the Moblan Lithium Project in northern Quebec.

In Western Australia, the Company holds a large tenement portfolio in the Pilbara region

prospective for gold and lithium. Sayona is exploring for Hemi-style gold targets in the world-class Pilbara region, while its lithium projects include Company-owned leases and those subject to a joint venture with Morella Corporation (ASX:1MC).

| ||

|