July-September 2014 Quarterly Performance Report October 2014

Sydney, Oct 20, 2014 AEST (ABN Newswire) - The China CleanTech Index provides the definitive measure of the performance of Chinese cleantech companies that are listed on stock exchanges around the world.

The cleantech industry is split into a number of sub-sectors as detailed in the table below. Each of the sub-sectors contains companies that have both environmental and economic benefits.

- Biogas

- Geothermal - Hot dry rocks and conventional

- Biofuels

- Low Emissions Transport Technologies

- Carbon Trading

- Solar Thermal and Photovoltaics

- Energy Efficiency & Biomaterials

- Waste Management & Recycling

- Energy Storage & Fuel Cells

- Water

- Environmental Services

- Wave, Tidal & Hydro

- Green Buildings

- Wind Generation

The cleantech sector is fundamentally different to Socially Responsible Investments (SRI) or Environmental, Social and Governance (ESG) performance. SRI and ESG look at incremental improvements in company performance and can be seen as 'operational hygiene' measures that find the best in class. Cleantech focuses on companies whose output positively enhances the communities and ecologies in which they reside. It is about doing 'more good' rather than 'less bad'.

With over 160 companies falling under the coverage of the Index and with a combined market capitalisation of over 1.1 trillion Renminbi (US$180 billion), the China CleanTech Index presents for the first time a picture of the Chinese cleantech industry's growth in a single measure.

The Index is weighted by market capitalisation and is benchmarked against the following indices to show its relative performance:

- Wilder Hill New Energy Global Innovation Index (NEX) - which measures the performance of global clean energy stocks

- Cleantech Index (CTIUS) - which measures the performance of global cleantech stocks

- China Shanghai Composite Index (SHCOMP) - which measures the performance of stocks listed in Shanghai.

- MSCI World (MSCI) - which provides a measure of the performance of global stock markets.

The rules for the formulation and management of the Index have been developed with reference to global best practice. An overview of these rules is provided in the annual performance report.

The China Cleantech Index is updated each month and published on the SinoCleantech website at www.sinocleantech.com and on the Australian CleanTech website at www.auscleantech.com.au. It is published internationally in conjunction with Cleantech Investor (www.cleantechinvestor.com) and in China in conjunction with Top Capital (www.topcapital.cn).

Monthly results can be emailed directly to interested parties by subscribing at www.sinocleantech.com.

China CleanTech Index Performance

The China CleanTech Index outperformed all but one of its four benchmarks for the month of September 2014 and recorded a gain of 2.0%.

The China CleanTech Index rose from 46.8 to 47.8 over the month of September recording a 2.0% gain. This compared to the NEX loss of 6.6%, the CTIUS loss of 6.9%, the Shanghai Composite gain of 6.6% and the MSCI loss of 2.9%. The China CleanTech 20 recorded a 1.9% loss.

Over the third quarter of 2014, the China CleanTech Index recorded a gain of 9.4%, outperforming all but one of its benchmark indices. Over the quarter, the NEX lost 7.5%, the CTIUS lost 10.9%, the Shanghai Composite gained 15.4% and the MSCI lost 2.6%.

The twelve month gain for the China CleanTech Index now stands at 14.5% outperforming all of its benchmarks. This twelve month gain is being driven by the China Water Index (+18.2%), the China Efficiency Index (+38.7%) and the China Hydro Index (+13.9%).

---------------------------------------------------------------------------Percentage 2009 2010 2011 2012 2013 SEP 3Q 6m 12m 3Change 2014 14 Yrs---------------------------------------------------------------------------(CCTI) 77.5% -9.6% -48.0% -16.5% 29.2% 2.0% 9.4% 6.9% 14.5% 6.0% (CCT20) 59.6% -15.6% -47.4% -15.5% 24.1% -1.9% 5.5% 1.9% 2.4% -6.8%(NEX) 39.7% -14.6% -40.2% -5.5% 53.7% -6.6% -7.5% -3.7% 13.7% 50.3% (CTIUS) 38.1% 7.3% -18.3% 7.3% 37.0% -6.9% -10.9% -10.0% 1.3% 42.8%(SHCOMP) 80.0% -14.3% -21.7% 3.2% -6.7% 6.6% 15.4% 16.2% 9.4% 0.2%(MSCI) 27.0% 9.6% -7.6% 13.2% 24.1% -2.9% -2.6% 1.5% 10.0% 53.8%----------------------------------------------------------------------------CCTI - China CleanTech Index CCT20 - China CleanTech 20 NEX - Wilder Hill New Energy Global Innovation IndexCTIUS - Cleantech Index SHCOMP - China Shanghai Composite Index MSCI - MSCI World

The market capitalisation of the 163 stocks in the China CleanTech Index after its rebalance is RMB 1.13 trillion (US$185 billion) which has set a new all time high. This is a long way up from the Index's trough of RMB 604 billion in November 2012.

Best and Worst Stocks

The best and worst performers in terms of share price performance over the month and third quarter of 2014 are shown in the table below.

Over the month, 16 companies recorded share price gains of more than 25% and 17 companies recorded losses of more than 25%.

Over the quarter, 17 companies recorded share price gains of more than 40% and 6 companies recorded losses of more than 40%.

September 2014

Best Performers

Share Price Gain > 25%

Cofco Biochemical (Anhui)

Guangzhou Zhiguang Electric

LED International Holdings Ltd.

Ledman Optoelectronic Co Ltd

SmartHeat Inc

Hebei Sailhero Environmental Protection High-tech

Leader Environmental Technologies Ltd

RINO International Corporation

Tinci Holdings Limited

Zhejiang Feida Environmental Science Technology

Risen Energy Co., Ltd.

Novarise Renewable Resources Ltd

Wuhan Sanzhen Industry Holding Co., Ltd

Sinohydro Group Ltd

China Energine International (Hldgs) Ltd

CleanTech Innovations Inc.

Worst Performers

Share Price Loss > 25%

Bodisen Biotech, Inc.

Canadian Solar Inc

China Sunergy

Comtec Solar Systems Group Limited

JinkoSolar Holding Co., Ltd.

LDK Solar

Shunfeng Photovoltaic International

Suntech Power Holdings

Trina Solar

Yingli Green Energy

Advanced Battery Technologies

China Sun Group High Tech Co.

Unilumin Group Co Ltd

China Industrial Waste Management Inc

Duoyuan Global Water

China Ming Yang Wind Power Group Ltd

Cleantech Solutions International Inc

Third Quarter 2014

Best Performers

Share Price Gain > 40%

Cofco Biochemical (Anhui)

Hanwei Energy Services

LED International Holdings Ltd.

Ledman Optoelectronic Co Ltd

Dalian East New Energy Development Co.,Ltd

Leader Environmental Technologies Ltd

Zhejiang Feida Environmental Science Technology

Beijing Jingyuntong Technology Co Ltd

Jiangsu Akcome Solar Science and Technology Co

China Industrial Waste Management Inc

Guangxi Guidong Electric

Heilongjiang Interchina Water Treatment Co Ltd

Sichuan Minjiang Hydropower Co., Ltd

Sinohydro Group Ltd

Yunnan Wenshan Electric Power Co., Ltd

CleanTech Innovations Inc.

Jiangsu Jixin Wind Energy

Worst Performers

Share Price Loss > 40%

Bodisen Biotech, Inc.

Comtec Solar Systems Group Limited

LDK Solar

Suntech Power Holdings

Jiangxi Ganfeng Lithium Co.,Ltd.

Cleantech Solutions International Inc

Index Rebalance

The China CleanTech Index underwent its quarterly rebalancing at the end of September which took account of recent share issues and other corporate activity. One company was removed from the index and no additional companies were added during this rebalance.

The company removed from the Index was China Hydroelectric Corporation which was delisted following its acquisition by CPT Wyndham Holdings Ltd.

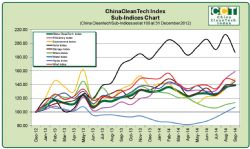

Component Sub-Indices

To provide an analysis of the China CleanTech Index, eight sub-indices have been developed. The performance of each of these sub-indices over the last five years and the current quarter are shown in the table and charts below.

Seven of the eight sub-indices recorded gains for the quarter. The best results were the 23.2% gain for the China Hydro Index and the 22.2% gain for the China Efficiency Index. The worst results were recorded by the 9.3% loss from the China Solar Index and 3.1% gain from the China Storage Index.

China CleanTech Sub-Indices

2009 2010 2011 2012 2013 3Q14China Efficiency Index 102.4% 31.8% -60.4% -30.9% 23.5% 22.2%China Environment Index 157.4% 13.5% -31.1% -21.8% 37.7% 21.9%China Solar Index 92.4% -13.0% -57.5% -36.2% 76.9% -9.3%China Storage Index 141.0% -15.1% -36.6% 11.7% 32.2% 3.1%China Waste Index 65.7% 99.1% -25.9% -12.5% 32.5% 5.8%China Water Index 113.5% 9.6% -49.7% -8.0% 37.6% 12.0%China Hydro Index 78.9% -35.6% -23.0% 1.1% -9.9% 23.2%China Wind Index 45.8% -21.0% -57.7% -32.5% 48.5% 4.6%

Index Component Companies

The 20 largest Index constituents by market capitalisation on 30 September 2014 are provided in the table below. These stocks will be the constituents of the China CleanTech 20 until the Index rebalance on 31 December 2014.

In the China CleanTech 20, the greatest sub-sector representations are Water with seven companies followed by Wind with four companies each.

New entrants to this list at this rebalance are Guangdong Golden Dragon Development, Hareon Solar Technology, Beijing SJ Environmental Protection and Beijing New Building Materials Public. These have taken the place of Sunfeng Photovoltaic, Comtec Solar, Tianjin Capital and Wuhan Linuo Solar Energy.

Company Sector Exchange Code1 China Yangtze Power C HYDRO Shanghai (SH) 600900.SS2 China Longyuan Power Group Corp WIND HKSE 0916.HK3 Sinohydro Group HYDRO Shanghai (SH) 601669.SS4 Beijing Enterprises Water Group WATER HKSE 0371.HK5 China Everbright International WATER HKSE 0257.HK6 GCL-Poly Energy Holdings SOLAR HKSE 3800.HK7 Beijing Originwater Technology WATER Shenzhen (SHE)300070.SZ8 Xinjiang Goldwind Science & Technology WIND Shenzhen (SHE)002202.SZ9 Chongqing Water Group Company WATER Shanghai (SH) 601158.SS10 Tsinghua Tongfang BIOMATERIALS Shanghai (SH) 600100.SS11 Sound Environmental Resources WASTE Shenzhen (SHE)000826.SZ12 Huaneng Renewables WIND HKSE 0958.HK13 Chengdu Xingrong Investment WATER Shenzhen (SHE)000598.SZ14 Beijing Capital WATER Shanghai (SH) 600008.SS15 Sinovel Wind Group WIND Shanghai (SH) 601558.SS16 Guangdong Golden Dragon Development WATER Shenzhen (SHE)000712.SZ17 Hareon Solar Technology SOLAR Shanghai (SH) 600401.SS18 Sichuan Tianqi Lithium Industries FUEL CELLS Shenzhen (SHE)002466.SZ19 Beijing SJ Environmental Protection ENVIRONMENTAL Shenzhen (SHE)300072.SZ20 Beijing New Building Materials Public BUILDINGS Shenzhen (SHE)000786.SZ

To view the report, please visit:

http://media.abnnewswire.net/media/en/docs/78394-3Q14-ENG.pdf

About Sino CleanTech

Sino CleanTech publishes the China CleanTech Index and facilitates Chinese Cleantech investments and provides services to Government agencies across Asia to help stimulate investment in the Cleantech industry. These investments include looking at listed cleantech stocks and direct investment into projects and companies. Sino Cleantech is active in facilitating:

Sino CleanTech publishes the China CleanTech Index and facilitates Chinese Cleantech investments and provides services to Government agencies across Asia to help stimulate investment in the Cleantech industry. These investments include looking at listed cleantech stocks and direct investment into projects and companies. Sino Cleantech is active in facilitating:

- Investment from Chinese investors into cleantech in both China and internationally; and

- Investment from international investors into the Chinese cleantech market.

Please contact us if you are looking for funding or seeking investments.

| ||

|