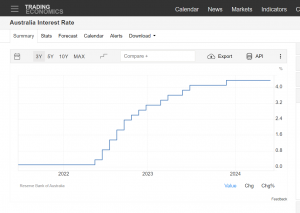

MELBOURNE, VICTORIA, AUSTRALIA, June 4, 2024 /EINPresswire.com/ -- The Reserve Bank of Australia (RBA) recently indicated holding the cash rate at 4.35% until mid-2024. With the interest rate not showing signs of decreasing, there is much anticipation regarding what it means for Australians.

According to AIHW, the median transfer price for an established house in Sydney was 615,000 in 2013, increasing to 1.2 million at the start of 2023. According to Realestate.com, some suburbs in Melbourne have seen around 900% to 1000% increase in the median house value in just 20 years. This signals a huge change in the affordability of all Australians.

The Australian economy and its affordability are characterised by a complex interplay of factors, with interest rates being one of the biggest determinants of consumer spending behaviours.

Interest rates are determined by the Reserve Bank of Australia and then passed on to lenders, who then pass them on to individuals and businesses. As interest rates fluctuate, the ripple effects are felt across diverse sectors, reshaping consumption patterns and influencing affordability dynamics in key industries such as groceries, utilities, and housing.

Interest rates significantly shape consumer spending habits by influencing borrowing capacity, disposable income levels, and overall consumer sentiment.

Recent shifts in interest rates, notably the Reserve Bank of Australia's (RBA) decision to maintain the official cash rate at a historic low of 0.1%, underscore the central bank's efforts to support economic recovery amidst ongoing uncertainties.

Australians are grappling with the dual challenges of rising living costs and constrained household budgets due to high rent, grocery bills, utility bills, etc.

Recent data from market research firm IBISWorld highlights a noticeable shift in grocery spending habits. Consumers are increasingly seeking value for money for non-essential products, fearing economic uncertainties.

Similarly, utility bills, such as electricity, gas, and broadband bills, have risen. Interest rates have an indirect effect on utilities and the cost of living.

As reported by the Australian Energy Regulator (AER), electricity prices have been steadily rising in recent years. As a result, households are bracing themselves for further escalations in utility expenses, prompting a concerted effort towards energy conservation and cost reduction measures.

Amidst rising living costs and constrained household budgets, housing affordability remains another pressing concern for many Australians. Both the soaring cost of rent and home ownership pose significant challenges for aspiring homebuyers and renters alike.

According to data from CoreLogic, the median rent for houses in capital cities across Australia surged by 8.3% in the year leading up to December 2023, reaching a record high of $490 per week.

Simultaneously, the Real Estate Institute of Australia (REIA) reports a staggering 22.5% increase in the national median house price in 2023, surpassing the $1 million mark for the first time.

Australians should be cautious when spending. Families and individuals should consider budgeting their everyday expenses by comparing pricing with online shopping or selecting utilities by comparing energy and NBN plans. As a consumer, you should compare Electricity and broadband plans and prices of frequently purchased items regularly.

Essential costs such as energy bills can slowly take up an increasing proportion of your monthly budget when you are not careful. To prevent this, consider using free comparison services such as CheapBills, Which help customers find potential savings on their electricity, gas and broadband bills. Alternatively, when moving homes, use Move-in Connect to find and connect your Power, Gas and broadband with some of the most competitive rates from Electricity providers and internet providers.

Some other measures include:

1. Meal Planning: Plan meals in advance to reduce food waste and avoid unnecessary spending on dining out or last-minute purchases.

2. Bulk Buying: Consider buying non-perishable items in bulk to reduce the frequency of shopping trips and take advantage of cost savings over time.

3. Energy Efficiency: Implement energy-saving measures at home, such as turning off lights and appliances when not in use, using energy-efficient appliances, and sealing drafts to reduce utility bills.

4. Transportation Savings: Explore alternative transportation options such as public transit, carpooling, or cycling to save on fuel and maintenance costs associated with owning a car.

5. Smart Shopping Habits: Avoid impulse purchases by making shopping lists and sticking to them, waiting for sales or discounts before making major purchases, and resisting the temptation to buy unnecessary items.

In tough economic times, It is hard to fundraising for your favorite cause. If you are looking to save and donate at the same time, try iCause. It is a first-of-its-kind crowdfunding platform that allows people to donate through the switch-and-donate feature. It uses Cheapbills comparison Engine, which shares 30% of its revenue toward the cause you want to support. For example, if you switch your electricity and gas, you can donate approximately $87 without taking a cent out of your pocket and still enjoy the savings on energy bills.

The platform allows you to share, like, and follow any campaign of your choice. You can download the iCause app, which syncs with your contracts, to invite people to your cause via Email or SMS. iCause is also compatible with conventional payments—you can donate with Visa, Master Card, Amex, and Paypal. iCause is changing the future of fundraising. The founder, Muhammad K Haider, is passionate about helping people and founded the platform so that more people can contribute towards fundraising and make a difference to support a cause of their choice.

For Media Inquiry:

Muhammad K Haider

iCause

+61 430 035 554

muhammad@icause.com.au

Visit us on social media:

Facebook

X

LinkedIn

Instagram

5 Tips to Improve Donations for Charities using icause!