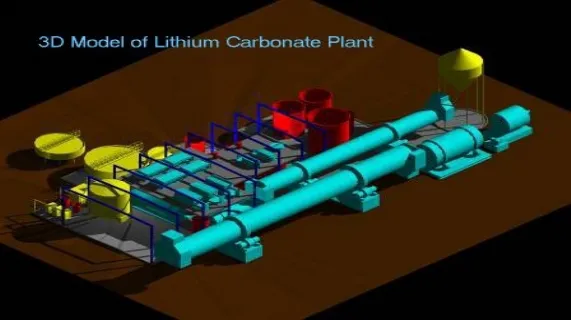

3D Model Of Lithium Carbonate Plant

Perth, April 28, 2009 AEST (ABN Newswire) - Emerging lithium producer, Galaxy Resources Limited (ASX:GXY) is pleased to announce positive results from a Pre-feasibility Study (PFS) into downstream processing of lithium carbonate from its Mt Cattlin Lithium-Tantalum project near Ravensthorpe. The PFS, which was completed three months ahead of schedule, investigated the viability of a value-adding downstream strategy to process the Mt Cattlin spodumene into battery grade lithium carbonate.

In January, Galaxy announced its intention to proceed with the development of the Mt Cattlin project, incorporating a 1 million tpa mine and concentrator at Mt Cattlin to produce spodumene and tantalum concentrate.

Galaxy Managing Director Iggy Tan said by moving further down the lithium battery supply chain, Galaxy would be able to significantly enhance the value of the Mt Cattlin Lithium-Tantalum project.

"Our mine DFS completed in December had already indicated that the "sale of spodumene concentrate" stage of the Mt Cattlin Lithium- Tantalum project was economically viable," said Mr Tan.

"Now, the results of the lithium carbonate PFS have confirmed that the Net Present Value of the project has increased and now ranges between $310 million to $360 million".

"By producing our own lithium carbonate we are able to gain greater control over the quality and pricing of the end product," he said. The lithium carbonate PFS results indicated that downstream chemical processing is viable, but that the economics of the project could be improved by locating the chemical plant closer to the end markets where there is a cheaper source of acid, soda ash, electricity and consumable costs. It is also expected that establishing a facility in China will require lower capital costs, resulting in a more robust project. Galaxy has commenced the next stage of the study by investigating several sites in China.

Pre Feasibility Study - Lithium Carbonate Production

After investigating various options, a sulphate processing technique was selected as the most appropriate. The sulphate route is an established and accepted processing method used extensively in China to convert spodumene to battery grade lithium carbonate. Galaxy has developed and established a risk free flow sheet that is very similar the current operating plants in China. (See Figure 1).

For the purpose of the study, a kiln feed rate of 137,000 tonnes per annum was assumed. The following key process steps have been proposed:

- Kiln Feed 137,000 tonnes @ 6% Li2O

- Decrepitation - rotary kiln

- Sulphating roast and leaching

- Precipitation and Ion exchange

- Lithium carbonate crystallisation

- Sodium Sulphate crystallisation

- 17,000 tonnes per annum lithium carbonate production

- Bulk shipment through Esperance port

-----------------------------------------Operating Parameters Quantity-----------------------------------------Spodumene Concentrate Feed 137,000 tpaSpodumene Concentrate Grade 6.0 % Li2OLithium Carbonate Production 17,000 tpa-----------------------------------------

The following contractors and consultants were employed on the Pre-feasibility Study:

- MSP Engineering Pty Ltd Process Plant and Site Infrastructure

- GRD Engineering Kiln designs

MSP Engineering Pty Ltd

The study team was led by two very experienced lithium joint study managers, Mr Peter McSweeney and Mr Mike Kitney. Mr McSweeney, is principal of MSP Engineering Pty Ltd and has many years of engineering experience, in particular lithium mineral processing experience with the Greenbushes Lithium and Tantalum operation in the South West of Western Australia.

Mr Kitney, besides also having extensive processing experience, was the principal process engineer for the lithium carbonate plant commissioned by Sons of Gwalia in 1995.

Project Economics

Capital and operating cost estimates will be released at on completion of the DFS stage, however the project Net Present Value (NPV) (real and non-geared, before tax, discount of 8%, FX $US:$A 0.65) is estimated to range between $A310 million^ to A$360 million^ and payback at less than 4 years.

The value adding processing strategy has shown close to a three-fold improvement of project returns compared to the previous "sale of spodumene only" model of $128 million* NPV. Galaxy intends to set up its own lithium chemical plant in China, where the technology is proven, accepted and well established. The project economics in China will further improve when this is incorporated.

The Next Stage - Complete DFS for Lithium Carbonate Plant in China

The next stage of feasibility work is to investigate establishing a similar lithium carbonate plant in China due to lower associated capital and operating costs, as well as being close to the strategic growing battery markets in Asia. Galaxy sees significant benefits in moving up the value adding chain to become both a producer and supplier of lithium chemicals. By selling Li2CO3 rather than just the spodumene mineral the Company will be able to add value to the resource and bring further upside to the Mt Cattlin Lithium Tantalum Project.

Developing a wholly owned plant in China is the preferred option as it provides Galaxy with complete control over the process and the quality of the product produced. The Company estimates capital cost for a similar lithium carbonate plant in China to be between 40%-60% of the Australian version. Similarly, operating costs for a Chinese operation is expected to have a 35%-45% reduction of operating costs. The main reasons are that operating costs are higher in Ravensthorpe due to the cost of electricity (which has to be generated on site), water and consumables like sulphuric acid and soda ash have to be shipped into Western Australia. Also, access to cement plants for waste residue disposal and detergent plants for sodium sulphate disposal are important factors that drive the economics of a lithium carbonate plant.

It should be noted that by retaining ownership of the carbonate plant, Galaxy will maximise the return flow of benefits to Australia and deliver further upside to the Mt Cattlin project in Ravensthorpe.

Galaxy is in the process of finalising an industrial site in China where there is ready access to key raw materials and consumables.

China Lithium Carbonate Industry Background

Chinese lithium processors have been converting spodumene ore into lithium chemicals from local and Australian (Greenbushes) sources for more than 20 years. The processors achieve high recovery and efficiency rates in the sulphate process and produce battery grades of lithium carbonate, lithium hydroxide, lithium metal and high purity lithium carbonate.. China has the technology, experienced personnel and significant demand for lithium products and by-products.

Approximately 15,000 to 20,000 tpa of lithium chemicals are currently produced in China from spodumene based production. The total market demand in China is around 25,000 tpa and this is expected to increase significantly from 2010 with the growth of the hybrid and electric vehicle market.

Lithium Battery Supply Chain

The concentrated spodumene ore is converted to lithium carbonate and supplied to the producers of cathode materials like lithium cobaltite, lithium iron phosphate and LiPF6 electrolyte. They, in turn, supply the product to cathode and battery assemblers who deliver the battery pack to the battery and car manufacturers. The majority of Chinese cathode manufacturers' use locally produced battery grades lithium carbonate as feedstock. The processors also produce 99.99% quality lithium carbonate that is used by the Japanese LiPF6 electrolyte manufacturers.

China Strategy - Key Points

1. Production of spodumene based lithium carbonate has been occurring in China for decades

2. The Chinese end product is accepted for lithium battery production

3. China has the technology and experienced people

4. A China-based lithium chemical plant will have lower capital and operating costs

5. Chinese consumption of lithium chemicals is large and expected to grow

6. Galaxy's strategy is to move up the value adding chain to bring further upside to the Mt Cattlin project

Notes:

^ real and non-geared, before tax, discount of 8%, FX $US:$A of 0.65, 15 year mine life.

* real and non-geared, before tax, discount of 8%, FX $US:$A of 0.72, 15 year mine life.

About Galaxy Resources Limited

Galaxy Resources Limited (ASX:GXY) (OTCMKTS:GALXF) is an international S&P / ASX 200 Index company with lithium production facilities, hard rock mines and brine assets in Australia, Canada and Argentina. It wholly owns and operates the Mt Cattlin mine in Ravensthorpe Western Australia, which is currently producing spodumene and tantalum concentrate, and the James Bay lithium pegmatite project in Quebec, Canada.

Galaxy Resources Limited (ASX:GXY) (OTCMKTS:GALXF) is an international S&P / ASX 200 Index company with lithium production facilities, hard rock mines and brine assets in Australia, Canada and Argentina. It wholly owns and operates the Mt Cattlin mine in Ravensthorpe Western Australia, which is currently producing spodumene and tantalum concentrate, and the James Bay lithium pegmatite project in Quebec, Canada.

Galaxy is advancing plans to develop the Sal de Vida lithium and potash brine project in Argentina situated in the lithium triangle (where Chile, Argentina and Bolivia meet), which is currently the source of 60% of global lithium production. Sal de Vida has excellent potential as a low cost brine-based lithium carbonate production facility.

Lithium compounds are used in the manufacture of ceramics, glass, and consumer electronics and are an essential cathode material for long life lithium-ion batteries used in hybrid and electric vehicles, as well as mass energy storage systems. Galaxy is bullish about the global lithium demand outlook and is aiming to become a major producer of lithium products.

| ||

|