Ore Reserve Estimate and Positive Pre-Feasibility Study Results for the Thackaringa Cobalt Project

Thackaringa Cobalt Project Pre-Feasibility Study

Thackaringa Cobalt Project Pre-Feasibility Study

Sydney, July 4, 2018 AEST (ABN Newswire) - Cobalt Blue Holdings Limited ( ASX:COB) (

ASX:COB) ( CBBHF:OTCMKTS) is pleased to report a maiden Ore Reserve Statement and Preliminary Feasibility Study for the Thackaringa Cobalt Project. Mining One has issued a JORC 2012 compliant Ore Reserve Statement to Cobalt Blue, and this is detailed in the following sections in accordance with ASX Listing Rule 5.9.1.

CBBHF:OTCMKTS) is pleased to report a maiden Ore Reserve Statement and Preliminary Feasibility Study for the Thackaringa Cobalt Project. Mining One has issued a JORC 2012 compliant Ore Reserve Statement to Cobalt Blue, and this is detailed in the following sections in accordance with ASX Listing Rule 5.9.1.

KEY POINTS:

- Cobalt Blue Holdings Limited (Cobalt Blue or Company) has now delivered a PFS study for the Thackaringa Cobalt Project and spent a minimum of A$2.5m to achieve Stage 2 goals under the Thackaringa Joint Venture Agreement.

- Results justify proceeding further towards commercial development of the Thackaringa Cobalt Project. The project will now begin Bankable Feasibility Studies (BFS).

- A maiden Ore Reserve is declared for the Thackaringa Cobalt Project - Probable Ore Reserve of 46.3M tonnes @ 819 ppm cobalt.

The PFS clearly demonstrated the Ore Reserve case for Thackaringa was NPV positive and that the project was economic.

A Production Target (Potential Upside Mining Case) was modelled using sensitivity analysis. The Production Target of 58.7M tonnes @ 802ppm cobalt included the Probable Ore Reserve and a partial component of the Inferred Resource. Production Target outcomes are set out in Table 2(see link below).

There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the production target itself will be realised.

- Completion of the PFS allows project financing negotiations to begin. A more detailed release on the objectives of the BFS, as well as the company's exploration plans for the next 12 months will be released in due course. Strong cash balance of A$9.8m as of 1 July 2018.

- Demand for cobalt continues to grow. According to CRU, demand will increase by 7% pa CAGR 2018-2021 supporting a global deficit even after near term African supply has entered the market.

While Cobalt Blue is pleased with the PFS outcomes, there are four key opportunities for investigation in the BFS:

- Optimisation of process plant tailings handling and storage: In the PFS, management of tailings amounted to A$260M over the life of the project, inclusive of capital and operating costs. A review study will be undertaken in Q3 2018 to identify possible cost saving measures.

- Optimisation of metal recoveries: Design criteria used during the PFS was based on batch testwork. Larger scale testing will be conducted during the BFS, incorporating recycle streams, which may increase overall metal recoveries.

- Optimisation of average power pricing: The PFS estimated that approximately 22% of the annual site cash costs were related to electrical power consumption from the National Electricity Market. Opportunities exist to consider onsite back-up power supply (larger scale batteries), and process plant operating philosophies, to limit consumption when the National Electricity Market prices reach short-lived peaks - intermittent peak pricing typically last for < 30 minutes.

- Opportunities to extend mine life: Potential to extend the project life by treating ore from inferred inventories from the known resources and from other sources beyond Thackaringa, represent opportunities for Cobalt Blue that would have significantly positive returns on capital if the Thackaringa project is developed.

Cobalt Blue's Chairman, Rob Biancardi said: "We are pleased to announce the PFS results for the world class Thackaringa Cobalt Project. The PFS demonstrates the potential for COB to become a leading global supplier of cobalt sulphate to the lithium-ion battery industry. The Project will now move into a Bankable Feasibility Study. Further resource work will target a 20-year mine life, as the Production Target case is limited to under 13 years."

Executive Summary

Cobalt Blue has completed the Preliminary Feasibility Study, and has subsequently served notice to Broken Hill Prospecting Limited ( ASX:BPL) (

ASX:BPL) ( BPLNF:OTCMKTS) ('BPL'), that Cobalt Blue has fulfilled the requirements of Stage 2 of the Thackaringa Joint Venture. The outcomes of the PFS are detailed in the following sections.

BPLNF:OTCMKTS) ('BPL'), that Cobalt Blue has fulfilled the requirements of Stage 2 of the Thackaringa Joint Venture. The outcomes of the PFS are detailed in the following sections.

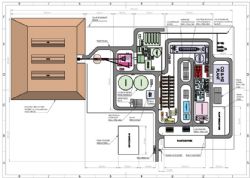

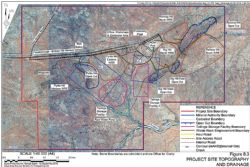

The PFS has detailed a technically feasible and economic project for production of cobalt sulphate heptahydrate and elemental sulphur from the Thackaringa deposits. The project assumed a 5.25Mtpa ore throughput rate. Using the mining ore reserve, a project life of 9.3 years (10 years of operations inclusive of ramp up period) was delineated.The Production Target mine life is extended to 12.8 years (13 years of operations inclusive of ramp up period).

The PFS was based on the following broad parameters:

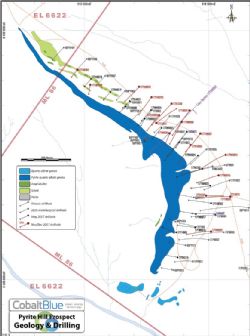

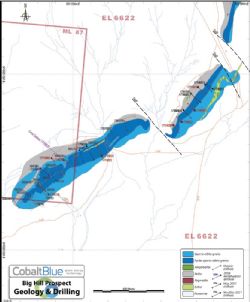

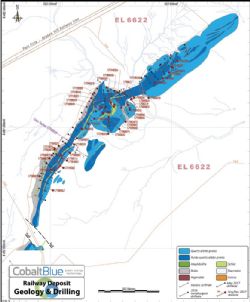

- Mineral Resource Estimate of 72Mt at 852ppm cobalt (Co), 9.3% sulphur (S) & 10% iron (Fe) for 61.5Kt contained cobalt (at a 500ppm cobalt cut-off) - ASX Announcement @ 19 March 2018.

- Open pit earth moving mining operation conducted by contractors.

- Processing plant and associated infrastructure built under engineering, procurement and construction (EPC) contracts with owner-operator management.

- Power and water supply for site, to be connected to existing Broken Hill networks. Broken Hill is connected to the National Electricity Market electrical power grid, and Broken Hill is supplied with raw water from various sources, including a raw water pipeline fed from the Murray River.

- Management of the project implementation by the Cobalt Blue Management Team (Owner's Team).

To view the full release with tables and figures, please visit:

http://abnnewswire.net/lnk/JQ4872U8

About Cobalt Blue Holdings Limited

Cobalt Blue Holdings Ltd (ASX:COB) (FRA:COH) (OTCMKTS:CBBHF) has a strategic approach that positions us to be among the first wave of new entrants into the allied battery materials supply chain. We are committed to playing a leading role in securing a stable and sustainable future for critical minerals.

Cobalt Blue Holdings Ltd (ASX:COB) (FRA:COH) (OTCMKTS:CBBHF) has a strategic approach that positions us to be among the first wave of new entrants into the allied battery materials supply chain. We are committed to playing a leading role in securing a stable and sustainable future for critical minerals.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:COB) (

ASX:COB) ( CBBHF:OTCMKTS) is pleased to report a maiden Ore Reserve Statement and Preliminary Feasibility Study for the Thackaringa Cobalt Project. Mining One has issued a JORC 2012 compliant Ore Reserve Statement to Cobalt Blue, and this is detailed in the following sections in accordance with ASX Listing Rule 5.9.1.

CBBHF:OTCMKTS) is pleased to report a maiden Ore Reserve Statement and Preliminary Feasibility Study for the Thackaringa Cobalt Project. Mining One has issued a JORC 2012 compliant Ore Reserve Statement to Cobalt Blue, and this is detailed in the following sections in accordance with ASX Listing Rule 5.9.1.  ASX:BPL) (

ASX:BPL) ( BPLNF:OTCMKTS) ('BPL'), that Cobalt Blue has fulfilled the requirements of Stage 2 of the Thackaringa Joint Venture. The outcomes of the PFS are detailed in the following sections.

BPLNF:OTCMKTS) ('BPL'), that Cobalt Blue has fulfilled the requirements of Stage 2 of the Thackaringa Joint Venture. The outcomes of the PFS are detailed in the following sections.  Cobalt Blue Holdings Ltd (ASX:COB) (FRA:COH) (OTCMKTS:CBBHF) has a strategic approach that positions us to be among the first wave of new entrants into the allied battery materials supply chain. We are committed to playing a leading role in securing a stable and sustainable future for critical minerals.

Cobalt Blue Holdings Ltd (ASX:COB) (FRA:COH) (OTCMKTS:CBBHF) has a strategic approach that positions us to be among the first wave of new entrants into the allied battery materials supply chain. We are committed to playing a leading role in securing a stable and sustainable future for critical minerals.