loading.........

Adelaide, Mar 1, 2017 AEST (ABN Newswire) - Havilah Resources Ltd ( ASX:HAV) is pleased to provide the Company's Quarterly Activities Report for the period ending 31 January, 2017.

ASX:HAV) is pleased to provide the Company's Quarterly Activities Report for the period ending 31 January, 2017.

HIGHLIGHTS FOR QUARTER

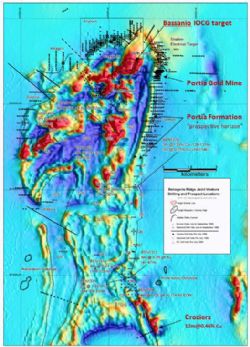

- Portia Gold Mine sales exceed 20,000 ounces, debt fully repaid and gold hedges closed out.

- Approvals received for 120 metre south wall cutback that will potentially extend Portia mining operations by a further 12 months.

- New scrubber procured, which eliminates a bottleneck to significantly increase ore throughput.

- Havilah actively pursuing development options for its Kalkaroo copper-gold and Mutooroo copper-cobalt projects in light of the favourable outlook for copper and cobalt.

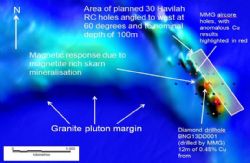

- New government supported exploration drilling programs commenced on high potential copper and gold targets in the Benagerie dome and tin targets at Prospect Hill.

PROMOTION

Havilah's Managing Director gave a presentation at the South Australian Exploration and Mining Conference in Adelaide on 2 December 2016, which is available on the following link:

http://www.abnnewswire.net/lnk/BI76081V

Havilah's website was redesigned and modernised to make it more user friendly and smart phone compatible. Links were created to Havilah's Twitter, LinkedIn, Facebook and YouTube pages. A subscription to ABN Newswire distributes all announcements across major global media platforms, and has substantially increased readership.

CORPORATE AND FINANCE

As at 31 January cash at bank was $1.9 million. This cash balance is after the early repayment of the Investec debt, the procurement of the scrubber and the construction of the balance pond at the Portia Gold Mine as noted above.

At the end of the quarter, the Company had 473 ounces of gold nuggets in inventory. 300 Ounces of these nuggets have already been committed under the gold forward sale announced on 11 March 2016. Gold concentrate in inventory at 31 January was approximately 84 ounces.

During the quarter Havilah made further debt repayments of $2.0 million, which resulted in the Company's debt related to the construction of the Portia Processing Plant being fully repaid. Havilah is now debt free, seven months after the first gold pour at the Portia Gold Mine and four months before the final repayment was due.

By 31 January the Company had delivered all 10,000 ounces hedged through spot deferred gold sales under the Investec Risk Management Facility, which had an average gold price of A$1,618. Future gold sales from Havilah will now be exposed to gold price movements.

During the quarter approximately 50,000 listed options and approximately 150,000 unlisted options were exercised resulting in approximately $55,000 in additional funds to the Company. At 31 January there were approximately 33.0 million $0.30 listed options outstanding, which will expire on 30 June 2017.

To view the full report, please visit:

http://abnnewswire.net/lnk/09Z6Y7EY

About Havilah Resources Ltd

Havilah Resources Ltd (ASX:HAV) is a debt free South Australian gold producer having recently financed and developed its first gold mine at Portia in north-eastern South Australia. It plans to follow on with three copper-gold-cobalt mining developments at North Portia, Kalkaroo and Mutooroo, which are underpinned by a JORC resources mineral inventory of over 1.4 million tonnes of copper, 3.6 million ounces of gold, and 18,000 tonnes of cobalt.

Havilah Resources Ltd (ASX:HAV) is a debt free South Australian gold producer having recently financed and developed its first gold mine at Portia in north-eastern South Australia. It plans to follow on with three copper-gold-cobalt mining developments at North Portia, Kalkaroo and Mutooroo, which are underpinned by a JORC resources mineral inventory of over 1.4 million tonnes of copper, 3.6 million ounces of gold, and 18,000 tonnes of cobalt.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:HAV) is pleased to provide the Company's Quarterly Activities Report for the period ending 31 January, 2017.

ASX:HAV) is pleased to provide the Company's Quarterly Activities Report for the period ending 31 January, 2017.  Havilah Resources Ltd (ASX:HAV) is a debt free South Australian gold producer having recently financed and developed its first gold mine at Portia in north-eastern South Australia. It plans to follow on with three copper-gold-cobalt mining developments at North Portia, Kalkaroo and Mutooroo, which are underpinned by a JORC resources mineral inventory of over 1.4 million tonnes of copper, 3.6 million ounces of gold, and 18,000 tonnes of cobalt.

Havilah Resources Ltd (ASX:HAV) is a debt free South Australian gold producer having recently financed and developed its first gold mine at Portia in north-eastern South Australia. It plans to follow on with three copper-gold-cobalt mining developments at North Portia, Kalkaroo and Mutooroo, which are underpinned by a JORC resources mineral inventory of over 1.4 million tonnes of copper, 3.6 million ounces of gold, and 18,000 tonnes of cobalt.