Tete Iron 2MTPA Production Scenario Demonstrates Advantages of Scalability with Robust Economics

London, June 18, 2013 AEST (ABN Newswire) - Baobab Resources Plc ( LON:BAO) is wholly focused in Mozambique where it is developing a pig iron and ferro-vanadium project in the Tete province (the 'Tete Project'), one of Africa's fastest growing mining centres. The International Finance Corporation ('IFC') holds a 15% participatory interest in the Tete Project.

LON:BAO) is wholly focused in Mozambique where it is developing a pig iron and ferro-vanadium project in the Tete province (the 'Tete Project'), one of Africa's fastest growing mining centres. The International Finance Corporation ('IFC') holds a 15% participatory interest in the Tete Project.

Further to the completion of a Pre-Feasibility Study that outlined a compelling commercial case for a 1Mtpa pig iron production facility and the engagement of Standard Chartered PLC as strategic corporate advisors (refer to RNS announcements dated 28 March 2013 and 13 June 2013), the Company is pleased to announce the results of an increased production scenario studying a 2Mtpa pig iron operation.

HIGHLIGHTS

- 2Mtpa model returned Pre-tax NPV10 of US$2.4bn, pre-tax IRR of 26%, capital expenditure of US$1.98bn and a payback period of 3-4 years.

- Modelled mine life of 22 years utilising only c.20% of the global 727Mt resources suggests yet further upside potential (refer to RNS dated 3 April 2013 for details on resource inventory).

- Very competitive operating cost of US$224/t (FOB) pig iron firmly establishes the project as one of the lowest cost producers globally.

- Co-production of ferro-vanadium alloy (FeV) adds significantly to the revenue stream and represents a by-product credit of c.US$66/t of pig iron (using US$25/kg FeV).

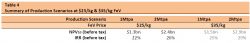

- Recently released Pre-Feasibility Studies assessing similar production scenarios in southern Africa estimate a ferro-vanadium price of $35/kg FeV. Table 1 illustrates the impact of an increased FeV price on the Tete Project's economics.

---------------------------------------------------------Table 1Summary of Production Scenarios at $25/kg & $35/kg FeV---------------------------------------------------------Production Scenario 1Mtpa 2Mtpa 1Mtpa 2MtpaFeV Price $25/kg $35/kgNPV10 (before tax) $1.3bn $2.4bn $1.5bn $2.9bnIRR (before tax) 22% 26% 25% 29%---------------------------------------------------------

- The Government of Mozambique offers various investment incentives for major industrial projects, with more favourable taxation terms for projects that add a significant amount of value in-country, create local employment and are export orientated. The completion of the PFS now enables the Company to enter into negotiations as to the structure of the tax treatment for the Tete Project with reference to established precedent agreements. It is for these reasons that the Company has not presented 'after-tax' figures.

Commenting today, Ben James, Baobab's Managing Director, said: 'The Tete Project PFS results from March showed the compelling economics of a 1Mtpa pig iron production scenario. These 2Mtpa results go a step further, demonstrating the ability to significantly scale up production at Tete, ratcheting up the NPV and IRR figures and thereby providing at least two economically attractive options for incoming strategic investors. We look forward to presenting these additional figures, together with the team from Standard Chartered, in our continuing talks with potential interested parties.'

2MTPA SCENARIO: SUMMARY

The Pre-Feasibility Study was completed by a leading group of internationally respected consulting firms and individuals including Coffey Mining Limited, John Clout and Associates, ProMet Engineers, SNC Lavalin, Coffey Environment and Ferrum Consultants. Equipment suppliers were also involved in the design and costing of the pyro-metallurgical flow sheets. Analysis was largely completed at the Amdel, ALS Chemex and CSIRO laboratories in Australia. The Study has been completed to a PFS-level of accuracy and is based on a number of process engineering initiatives including raw materials analysis, bench scale test work and the process comparison with similar, existing pig iron production plants.

Results of the Base Case 1 million tonnes per annum ('Mtpa') pig iron production scenario were reported to the market in detail on 28 March 2013 ( www.baobabresources.com/files/BAO_AIMRelease20130328PFS.pdf ). Subsequently, further work has been completed on assessing an expanded production scenario of 2Mtpa pig iron.

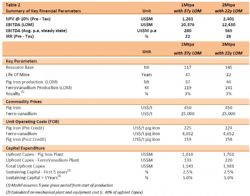

The studies indicated that there is the potential to establish an economically viable operation at the Tete Project at either 1Mtpa or 2Mtpa pig iron production and associated ferro-vanadium co-production. The production of pig iron was evaluated using tried and tested beneficiation, reduction and smelting technologies, which are well established in similar commercial operations worldwide, including South Africa and New Zealand. The base case scenario of 1Mtpa pig iron production estimated a capital expenditure of US$1.14bn and delivered strong project economics, with pre-tax NPV10 of USD1.3bn, a pre-tax IRR of 22% and a payback period of 4-5 years. The 2Mtpa model reported an estimated capital expenditure of US$1.98bn, a pre-tax NPV10 of USD2.4bn, a pre-tax IRR of 26% and a payback period of 3-4 years. A side-by-side analysis of the two models is presented in Table 2.

The Government of Mozambique offers various investment incentives for major industrial projects, with more favourable taxation terms for projects that add a significant amount of value in-country, create local employment and are export orientated. For instance, BHP Billiton's Mozal aluminium smelter and Kenmare's Moma mineral sands project have both been granted Industrial Free Zone (IFZ) status which makes them exempt from corporation tax, import duties, export duties and Value Added Tax while requiring payment of a 1% turnover tax. The completion of the PFS now enables the Company to enter into discussions with the Government of Mozambique as to the structure of the tax regime for the Tete Project. It is for these reasons that the Company has not presented 'after tax' figures.

-------------------------------------------------------------Table 2------------------------------------------------------------- 1Mtpa 2MtpaSummary of Key Financial Parameters Unit with 37y LOM with 22y LOM-------------------------------------------------------------NPV @ 10% (Pre - Tax) US$M 1,261 2,401EBITDA (LOM) US$M 10,376 12,430EBITDA (Avg. p.a, steady state) US$M p.a 280 565IRR (Pre - Tax) % 22 26------------------------------------------------------------- 1Mtpa 2Mtpa Unit with 37y LOM with 22y LOM-------------------------------------------------------------Key ParametersResource Base Mt 117 145Life Of Mine Years 37 22Pig Iron production(LOM) Mt 37 44FerroVanadium Production (LOM) Kt 119 141Royalty (1) % 3% 3%-------------------------------------------------------------Commodity Prices Pig Iron US$/t 450 450Ferro-vanadium US$/t 25,000 25,000-------------------------------------------------------------Unit Operating Costs (FOB)Pig Iron (Pre Credit) US$/t pig iron 225 224Ferro-vanadium US$/t pig iron 4,652 4,652Pig Iron (Post Credit)US$/t pig iron 159 158-------------------------------------------------------------Capital Expenditure Upfront Capex - Pig Iron Plant US$M 1,010 1,761Upfront Capex - FerroVanadium Plant US$M 133 220Total Upfront Capex US$M 1,143 1,981Sustaining Capital - First 5 years(2) % 2.5% 2.5%Sustaining Capital - > 5Years(2) % 5.0% 5.0%-------------------------------------------------------------(1) Model assumes 5 year grace period from start of production(2) Calculated on mechanical plant and equipment cost (c. 40% of upfront Capex)

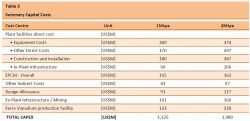

Due to the modular nature of the mineral processing equipment, the overall flow sheet contemplated in the 1Mtpa Base Case study remains largely unchanged in the 2Mtpa study. The estimated capital expenditure of a 2Mtpa operation compares favourably with the 1Mtpa model, an analysis of which is presented in Table 3. The Pre-Feasibility Study modelled pig iron production over a 37-year and 22-year mine life (1Mtpa and 2Mtpa scenarios respectively) which resulted in the development of just 15% to 20% of the total 727Mt resource, clearly highlighting the opportunity for expanded production scenarios.

Table 3 Summary Capital Costs ----------------------------------------------------Cost Centre Unit 1Mtpa 2Mtpa----------------------------------------------------Plant facilities direct cost Equipment Costs [US$M] 200 374 Other Direct Costs [US$M] 170 297 Construction and Installation [US$M] 180 387 In-Plant Infrastructure [US$M] 90 206EPCM - Overall [US$M] 115 162Other Indirect Costs [US$M] 43 57Design Allowance [US$M] 93 117Ex-Plant Infrastructure/Mining [US$M] 101 160Ferro Vanadium production facility [US$M] 133 220---------------------------------------------------- TOTAL CAPEX [US$M] 1,125 1,980----------------------------------------------------

The mineralisation at Tete includes significant amounts of vanadium which will be extracted as a vanadium slag during the smelting process. Further refining of the vanadium slag results in the production of ferro-vanadium alloy (FeV), currently sold at price levels of more than US$25/kg. Recently announced Pre-feasibility Studies completed by other AIM listed companies assessing similar production scenarios in southern Africa are quoting long-term FeV prices of US$35/kg. A sensitivity analysis of the two production scenarios using both US25/kg and US$35/kg FeV has been completed and is presented in Table 4.

Table 4Summary of Production Scenarios at $25/kg & $35/kg FeV------------------------------------------------------ Production 1Mtpa 2Mtpa 1Mtpa 2MtpaScenario------------------------------------------------------FeV Price $25/kg $35/kg------------------------------------------------------NPV10 (before tax) $1.3bn $2.4bn $1.5bn $2.9bnIRR (before tax) 22% 26% 25% 29%------------------------------------------------------

The information in this release that relates to Exploration Results is based on information compiled by Managing Director Ben James (BSc). Mr James is a Member of the Australasian Institute of Mining and Metallurgy, is a Competent Person as defined in the Australasian Code for Reporting of exploration results and Mineral Resources and Ore Reserves, and consents to the inclusion in the report of the matters based on the information in the form and context in which it appears.

To View all tables and full release, please visit:

http://media.abnnewswire.net/media/en/docs/75349-lon-bao-20130616.pdf

About Baobab Resources plc

Baobab Resources plc (LON:BAO) is a Mozambican-focused explorer with a large landholding in the central north of the country. The company's flagship project is the Tete iron ore deposit.

Baobab Resources plc (LON:BAO) is a Mozambican-focused explorer with a large landholding in the central north of the country. The company's flagship project is the Tete iron ore deposit.

| ||

|