Farm-In Joint Venture Agreements Adjacent to Yinnetharra

Perth, Mar 11, 2024 AEST (ABN Newswire) - Delta Lithium Limited ( ASX:DLI) is pleased to announce the execution of binding Farm in Joint Venture Agreements with both Voltaic Strategic Resources Ltd (

ASX:DLI) is pleased to announce the execution of binding Farm in Joint Venture Agreements with both Voltaic Strategic Resources Ltd ( ASX:VSR) and Reach Resources Limited (

ASX:VSR) and Reach Resources Limited ( ASX:RR1) for tenements surrounding the Yinnetharra project area in the Gascoyne region of Western Australia.

ASX:RR1) for tenements surrounding the Yinnetharra project area in the Gascoyne region of Western Australia.

Highlights:

- Binding Farm-in Joint venture Agreements executed with both Voltaic Strategic Resources Ltd ( ASX:VSR) and Reach Resources Limited (

ASX:VSR) and Reach Resources Limited ( ASX:RR1) to Earn-In ownership of tenement packages in the exciting Yinnetharra region.

ASX:RR1) to Earn-In ownership of tenement packages in the exciting Yinnetharra region.

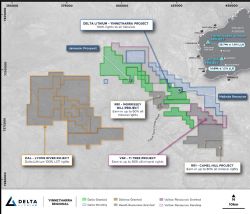

- The tenement packages in total cover an additional 413km2 and are located adjacent to and along strike from the emerging resource already defined at Malinda, within the 100% owned Yinnetharra Lithium Project.

- As a result of these transactions Delta's footprint in the emerging Gascoyne lithium province has increased by over 30% to 1,769km2.

- Earn-in Agreements for up to 80% of the following tenement packages:

o Voltaic's Ti Tree Project (243km2) which overlays extensive Leake Springs mafic-sediment package that hosts mineralised pegmatites at Delta's Malinda Lithium deposit (25.7Mt @ 1.0% Li2O).

o Reach Resources' Morrissey Hill and Camel Hill (170km2) Projects, which overlays extensive Lithium prospective host stratigraphy and Lithium soil anomalies

For ~$4.5 million upfront, Delta has secured the right to earn-in to three projects that are adjacent to the existing Yinnetharra Lithium Project. Earn-ins for equity positions of up to 80% in each project can be achieved with various deferred spending commitments.

Commenting on the transactions Managing Director, James Croser said;

"Delta is pleased to enter this strategic collaboration concurrently with Voltaic Strategic Resources and Reach Resources, simultaneously gaining access to the expanded prospective stratigraphy in addition to our existing Yinnetharra tenure, that has already delivered an impressive maiden resource at Malinda. The combined land package significantly boosts the potential for a long-life lithium operation in the region. Both Voltaic and Reach shareholders are poised to directly benefit from Delta's existing on-site presence at Yinnetharra and the expertise that our team will apply to our expanded footprint starting immediately.

"With such a dominant footprint in the region, particularly across the highly prospective Leake Springs metamorphic unit adjacent to the Thirty Three suite granite, this deal increases the likelihood of a regional scale project which all shareholders can now benefit from. We look forward to working with our new partners and delivering on this potential."

Yinnetharra Expansion

Delta has signed binding agreements with both Voltaic Strategic Resources Ltd ( ASX:VSR) and Reach Resources Limited (

ASX:VSR) and Reach Resources Limited ( ASX:RR1) to secure access to the following project areas. Each agreement has two stages that allow for Delta to earn-in to up 80% of the mineral rights within the projects.

ASX:RR1) to secure access to the following project areas. Each agreement has two stages that allow for Delta to earn-in to up 80% of the mineral rights within the projects.

Voltaic Strategic Resources

The agreement with VSR includes the Ti Tree Project area, located to the south of the existing Yinnetharra Project and approximately 10km south-east of the Malinda Resource. The tenement covers 243km2 and overlays extensive Leake Spring mafic-sediment package, similar to the geological setting that hosts the Malinda Resource. The details of the agreement are summarised in the two stages below.

Stage 1

1. DLI to pay VSR $1.25M cash upon commencement.

2. DLI can earn-in 51% of the Project by spending $3M over initial 2 years from commencement.

3. DLI to manage the Project, in consultation with VSR.

4. DLI may withdraw from the project at any time during the Stage 1 Earn-in Phase with 0% interest, however DLI must incur a minimum expenditure of $1M before withdrawing from Stage 1.

5. Cash/shares at DLI's election to VSR to the value of $500,000 in DLI upon satisfying the Stage 1 51% Participating Interest requirements.

Stage 2

6. DLI can earn a further 29%, taking equity to 80% upon further spend of $6.25M over the next 2 years or delivery of MRE >10Mt @ 0.8% Li2O (at 0.5% cutoff).

7. On completion of Stage 2, VSR can elect to either maintain its 20% by co-contributing; or dilute its 20% interest. DLI and VSR may agree to the purchase by DLI of VSR's 20% interest for a fair market value as agreed.

8. If VSR dilutes to <5% Participating Interest, DLI will have the option to purchase VSR's interest at fair market value (as agreed or determined by an expert).

9. Cash/shares at DLI's election to VSR to the value of $1,000,000 in DLI upon satisfying the Stage 2 80% Participating Interest requirements.

10. The Deal is subject to usual warranties relating to an agreement of this nature.

Reach Resources

The agreement with RRL includes two project areas, the Morrissey Hill Project and the Camel Hill Project.

Morrissey Hill is located approximately 8km south-west of Malinda and 12km south-east of the Jameson Prospect. Camel Hill is located due south and directly adjacent to the Ti Tree Project area which is subject to the agreement with VSR.

Morrissey Hill and Camel Hill 170km2.

Both have demonstrated prospectivity as indicated by strong Li soil geochemical anomalies, extensive host stratigraphy and extensive historical mines for lithium related minerals.

The details of the agreement with Reach are summarised in the two stages below.

Stage 1

1. DLI to pay RRL $3.2M cash upon commencement.

2. DLI to manage the Project, with an agreed reporting framework, and in consultation with RRL.

3. DLI can earn 51% of the Project by spending $3M on exploration over initial 2 years from commencement, with at least 50% of expenditure to be attributed to drilling.

Stage 2

4. DLI can earn a further 29%, taking equity to 80%, upon further spend of $6M over the next 2 years from Stage 1 completion, with at least 50% of expenditure to be attributed to drilling.

5. On completion of Stage 2, RRL can elect to either maintain its 20% by co-contributing; or dilute its 20% interest. DLI and RRL may agree to the purchase by DLI of RRL's 20% interest for a fair market value as agreed by the parties negotiating in good faith.

6. Cash/shares at DLI's election to RRL to the value of approximately $10M in DLI upon discovering a mineral resource estimate (as that term is defined in the JORC Code) of equal to or greater than 7.5Mt at 0.8% Li2O (at a 0.5% cut off grade).

7. The Deal is subject to usual warranties relating to an agreement of this nature.

These agreements have significantly increased Delta's footprint in the region by 30.5%. Our team of expert geologists strongly believes that the broader Yinnetharra region has potential to become a new Western Australian lithium province. These agreements provide Delta with important potential growth avenues for the future.

The next steps for these projects involves detailed planning of explorations activities. This will contribute to the minimum spend requirements for each agreement but also prioritise targets for upcoming drilling programs.

*To view tables and figures, please visit:

https://abnnewswire.net/lnk/N44G733Y

About Delta Lithium Limited

Delta Lithium Limited (ASX:DLI) is an exploration and development company focused on bringing high-quality, lithium-bearing pegmatite deposits, located in Western Australia, into production. With a strong balance sheet and an experienced team driving the exploration and development workstreams, Delta Lithium is rapidly advancing its Mt Ida Lithium Project towards production. The Mt Ida Lithium Project holds a critical advantage over other lithium developers with existing Mining Leases and heritage agreements in place. To capitalise on the prevailing buoyant lithium market, Delta Lithium is pursuing a rapid development pathway to unlock maximum value for shareholders.

Delta Lithium Limited (ASX:DLI) is an exploration and development company focused on bringing high-quality, lithium-bearing pegmatite deposits, located in Western Australia, into production. With a strong balance sheet and an experienced team driving the exploration and development workstreams, Delta Lithium is rapidly advancing its Mt Ida Lithium Project towards production. The Mt Ida Lithium Project holds a critical advantage over other lithium developers with existing Mining Leases and heritage agreements in place. To capitalise on the prevailing buoyant lithium market, Delta Lithium is pursuing a rapid development pathway to unlock maximum value for shareholders.

Delta Lithium also holds the highly prospective Yinnetharra Lithium Project that is already showing signs of becoming one of Australia's most exciting lithium regions. The Company is currently undergoing an extensive 400 drill hole campaign to be completed throughout 2023.

| ||

|