Resource Estimates for Three Sub-salt Exploration Wells

Brisbane, April 18, 2023 AEST (ABN Newswire) - Central Petroleum Limited ( ASX:CTP) (

ASX:CTP) ( C9J:FRA) (

C9J:FRA) ( CNPTF:OTCMKTS) provides resource estimates for the three well sub-salt exploration program scheduled to commence drilling later this year / early 2024, targeting helium, naturally-occurring hydrogen and natural gas.

CNPTF:OTCMKTS) provides resource estimates for the three well sub-salt exploration program scheduled to commence drilling later this year / early 2024, targeting helium, naturally-occurring hydrogen and natural gas.

Key points

- Central's share of gas resources across the three prospects are estimated to be in the order of:

o 44.8 billion cubic feet (bcf) of helium, including a prospective resource of 40.5 bcf at Dukas and Mahler (best estimate) and a 2C contingent resource of 4.3 bcf at Jacko Bore (Mt Kitty);

o 56.7 bcf of naturally-occurring hydrogen including a prospective resource of 51.4 bcf1 at Dukas and Mahler (best estimate) and a 2C contingent resource of 5.3 bcf at Jacko Bore (Mt Kitty); and

o 272 bcf of natural gas, including a prospective resource of 262.6 bcf at Dukas and Mahler (best estimate) and a 2C contingent resource of 9.4 bcf at Jacko Bore (Mt.Kitty).

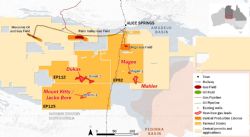

- The exploration program will be operated by Santos, with Central being carried (i.e. funded) by Peak Helium for two of the new sub-salt exploration wells: one at Jacko Bore (Mt Kitty) (EP 125) (funded to a cap for Central's share of $4.8m) and the other at the nearby Mahler prospect (EP 82) (funded to a cap for Central's share of $5.8m).

"With completion of the Peak farmout, we now look forward to the most significant exploration drilling program ever undertaken by Central in the Amadeus Basin, including the opportunity to test a discovery at Mt Kitty that previously registered 9% helium, and penetration of subsalt formations for the first time at Dukas and Mahler. Given the size of the prospective and contingent resources at each of these prospects, success could be transformative for Central, both in scale and potential to diversify into helium and hydrogen", said Leon Devaney, Central's Managing Director/CEO.

Details of the proposed wells and estimates of the resources to be targeted by each well are set out below:*

Jacko Bore 2 (EP125)

(Central 24%; Peak Helium 56%; Santos 20%)

The Jacko Bore 2 exploration well will target helium, naturally-occurring hydrogen and natural gas in the fractured basement by re-entering the existing Mt Kitty-1 (Jacko Bore-1) well and rilling a deviated/horizontal sidetrack to test up to 500m of the fractured basement reservoir at a depth of approximately 2,000m. The vertical Mt Kitty-1 exploration well flowed at up to 530,000 scfd, including 11.5% hydrogen and 9% helium.

Central estimates that its share of 2C contingent gas resources at Jacko Bore is 4.3 bcf of helium, 5.3 bcf of hydrogen and 9.4 bcf of natural gas:*

The Jacko Bore-2 well is expected to be drilled in late 2023 / early 2024, with up to $4.8 million of Central's costs to be carried by Peak Helium.

Mahler (EP82)

(Central 29%; Peak Helium 51%; Santos 20%)

The Mahler exploration well will target helium, naturally-occurring hydrogen and natural gas in the fractured basement and Heavitree formation at depths up to 2,000m. The well is planned to be drilled approximately 20km to the southeast of the Magee-1 exploration well which flowed gas, including 6.2% helium.

Central estimates that its share of prospective gas resources at Mahler could be in the order of 0.6 bcf of helium, 0.6 bcf of hydrogen and 2.9 bcf of natural gas (best estimate):*

Dukas 2 (EP112)

(Central 35%; Peak Helium 35%; Santos 30%)

The Dukas-2 well is planned to follow the Dukas-1 exploration well which was drilled in 2019 and suspended after encountering hydrocarbon-bearing gas from an overpressured zone close to the primary target at a depth of 3,704m. Traces of helium and hydrogen were detected in mud gases associated with the overpressured zone. The Dukas-2 well will target the same tight sandstone in the Heavitree formation below the salt seal with a higher-capacity rig in early 2024.

Central estimates that its share of prospective gas resources at Dukas could be in the order of 39.9 bcf of helium, 50.8 bcf of hydrogen and 259.7 bcf of natural gas (best estimate):*

*To view tables and figures, please visit:

https://abnnewswire.net/lnk/525990M9

To view the Central Petroleum Limited ( ASX:CTP) QUPEX Company Presentation, please visit:

ASX:CTP) QUPEX Company Presentation, please visit:

https://www.abnnewswire.net/lnk/UUMAT2TM

About Central Petroleum Limited

Central Petroleum Limited (

Central Petroleum Limited ( ASX:CTP) is an established ASX-listed Australian oil and gas producer (ASX:CTP) with exploration and appraisal permits in the Northern Territory (NT). Central has grown to become the largest onshore gas operator in the NT, supplying residential and industrial customers in the NT and wider Australian east coast market.

ASX:CTP) is an established ASX-listed Australian oil and gas producer (ASX:CTP) with exploration and appraisal permits in the Northern Territory (NT). Central has grown to become the largest onshore gas operator in the NT, supplying residential and industrial customers in the NT and wider Australian east coast market.

Central is seeking to become a major domestic energy supplier, in addition to helium and naturally occurring hydrogen, with exploration, appraisal and development plans across 169,112 km2 of tenements the NT, including some of Australia's largest known onshore conventional gas prospects in the Amadeus Basin.

| ||

|