Operational and Commercial Update - 2nd Gold Pour

Operational and Commercial Update - 2nd Gold Pour

Brisbane, Mar 14, 2023 AEST (ABN Newswire) - Further to its ASX release of 20 February 2023, Tombola Gold Ltd ( ASX:TBA) wishes to provide the market with a further operational and commercial update.

ASX:TBA) wishes to provide the market with a further operational and commercial update.

HIGHLIGHTS

- Second gold pour of 9.66kgs took place on 4 March 2023, realising $724,000 of revenue (265.312 Ozs Au payable at a realised gold price was $2,743.25 / Oz Au) after refining at the Australian Bullion Company.

- Processing continued at GAM processing plant although further mechanical problems were experienced resulting in a 5-day shutdown with processing resuming on 6 March 2023.

- Mill recoveries were at 91% over the month, although gold production is lower than modelled, resulting in smaller than predicted cash flow.

Update on Activities at the Company's Cloncurry Gold Projects

The second gold pour was achieved on 4 March 2023 of 9.66 kg of gold (264.15 Ozs Au payable), which was despatched to ABC Refineries with the amount of $724,000 being received in the Company's bank account on 7 March 2023.

Processing at the Great Australian Mine (GAM) plant has continued under normal operations, despite a further setback in the plant where a spool from the cyclone feed pump developed a hole that needed to be repaired, causing four days stoppage for repair work to be carried out. The mill recommenced processing on 6 March 2023.

Recovered grades during the month were lower than expected based on the grade estimates from the geological resource block model and in-pit grade control sampling results.

As of the end of February 2023, 40,000t of ore had been crushed at GAM, with another 16,000t waiting to be crushed at the GAM ROM pad, with 36,000t remaining at the ROM pad at the Golden Mile. Following the processing the remaining ore at GAM, with the benefit of a new installation of cyanide treatment, the Company will be make a decision on the viability of processing the rest of the ore at Golden Mile.

The reasons for the lower grades than predicted from the resource and grade control modelling are currently being assessed, but there appears to have been additional dilution during mining coupled with a greater orebody complexity (understanding that the mineralisation consists of narrow sub-vertical vein gold lodes). Additionally, final mill reconciliations still need to be carried out once decommissioning has been completed.

Update on the Company's South Australian Burra Project

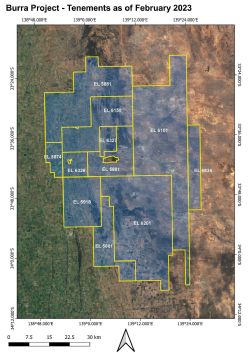

Following meetings held with the SA Dept of Energy and Mining last December, and as part of the recent review / renewal process, it was agreed that the Company (via subsidiary Ausmex SA) was required to make a compulsory relinquishment of various areas within the Burra portfolio. These areas were mostly from the less prospective western part of the tenement portfolio where limited work had been carried out.

Importantly the Company retained the key strategic areas of interest along the highly prospective Burra / Princess Royal corridor, and to the east in the equally prospective Delamerian (Nackara Arc) buried under younger sedimentary cover. These areas were the subject of the technical report by the Company's thirdparty consultant Ken Collerson (refer ASX release of 29 March 2022).

Accordingly, whilst the total area under tenure has been reduced from 6,561km2 to 3,565km2, the Company's exploration strategy and plans for Burra have not been impacted. It is to be noted that the 3,565km2 is still a significant tenement package in a key-mineral belt, highly prospective for copper and gold ore deposits.

As part of the tenement reduction, the Company's annual expenditure arrangements (AEA) were significantly reduced, a significant benefit to the area's reduction, as the expenditures (both annual and historical rolled over from previous years) were unsustainable covering such a large area. Currently the new revised AEA over the 3,565km2 that covers the period 1 April 2022 to 31 March 2024 is $1,220,000.

A new map of the revised tenement holding for Burra is attached (Appendix A*), together with a table showing the tenement changes (Appendix B*). The area reduction does not impact on the exploration strategy of the Company at all, as the relinquished ground predominantly covered the less prospective ground to the west of the main Burra mineral field.

As part of this tenement and activity review with the Department of Energy and Mining in SA, the previously signed Accelerated Discovery Initiative (ADI) Funding Agreement (11 November 2020) between Ausmex SA and the Department of Energy and Mining that provided a reimbursable grant to the Company of $300,000 for a combination of geophysics and drilling to be carried out on the ground, was terminated due to the expiry of timeframes within which the activities were to be carried out. No payments of funding were made to Ausmex, and no costs have been incurred in relation thereto.

Corporate Update

The Company has requested an extension to its voluntary suspension for a further period of three (3) weeks so that the Company may conduct processing the remaining ore at GAM.

Updated mine schedules are currently being worked on with Tombola's mining consultants, and a revised operational plan is expected to be available later this month.

*To view tables and figures, please visit:

https://abnnewswire.net/lnk/14GTK4N5

About Tombola Gold Ltd

Tombola Gold Ltd (ASX:TBA) is a company assembled by experienced, exceedingly well-qualified and all very well rounded team members that have previously floated exploration companies which achieved major resource discoveries and success. Between the Tombola team members, Tombola as a company have well over 100 years of accumulated experience in the mining, exploration and resource sector. Tombola principal objective is to acquire assets to explore for and develop a large IOGC or porphyry deposit funded by low-risk gold production resources. To that end, Tombola has a license covering 970 sq km prospective for gold/copper in the Mount Bryan-Red Banks-World's End area near Burra in South Australia; with strategic agreements with Queensland Mining Corporation.

Tombola Gold Ltd (ASX:TBA) is a company assembled by experienced, exceedingly well-qualified and all very well rounded team members that have previously floated exploration companies which achieved major resource discoveries and success. Between the Tombola team members, Tombola as a company have well over 100 years of accumulated experience in the mining, exploration and resource sector. Tombola principal objective is to acquire assets to explore for and develop a large IOGC or porphyry deposit funded by low-risk gold production resources. To that end, Tombola has a license covering 970 sq km prospective for gold/copper in the Mount Bryan-Red Banks-World's End area near Burra in South Australia; with strategic agreements with Queensland Mining Corporation.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:TBA) wishes to provide the market with a further operational and commercial update.

ASX:TBA) wishes to provide the market with a further operational and commercial update. Tombola Gold Ltd (ASX:TBA) is a company assembled by experienced, exceedingly well-qualified and all very well rounded team members that have previously floated exploration companies which achieved major resource discoveries and success. Between the Tombola team members, Tombola as a company have well over 100 years of accumulated experience in the mining, exploration and resource sector. Tombola principal objective is to acquire assets to explore for and develop a large IOGC or porphyry deposit funded by low-risk gold production resources. To that end, Tombola has a license covering 970 sq km prospective for gold/copper in the Mount Bryan-Red Banks-World's End area near Burra in South Australia; with strategic agreements with Queensland Mining Corporation.

Tombola Gold Ltd (ASX:TBA) is a company assembled by experienced, exceedingly well-qualified and all very well rounded team members that have previously floated exploration companies which achieved major resource discoveries and success. Between the Tombola team members, Tombola as a company have well over 100 years of accumulated experience in the mining, exploration and resource sector. Tombola principal objective is to acquire assets to explore for and develop a large IOGC or porphyry deposit funded by low-risk gold production resources. To that end, Tombola has a license covering 970 sq km prospective for gold/copper in the Mount Bryan-Red Banks-World's End area near Burra in South Australia; with strategic agreements with Queensland Mining Corporation.