Update in Respect of Competing Takeover Offers for Cardinal

Perth, Oct 20, 2020 AEST (ABN Newswire) - Cardinal Resources Limited ( ASX:CDV) (

ASX:CDV) ( C3L:FRA) (

C3L:FRA) ( CRDNF:OTCMKTS) (

CRDNF:OTCMKTS) ( TSE:CDV) is providing an update to shareholders in reference to the ongoing takeover offers for the Company by Shandong Gold Mining (HongKong) Co., Ltd. ("Shandong Gold") and Nord Gold S.E. ("Nordgold").

TSE:CDV) is providing an update to shareholders in reference to the ongoing takeover offers for the Company by Shandong Gold Mining (HongKong) Co., Ltd. ("Shandong Gold") and Nord Gold S.E. ("Nordgold").

Status of Takeover Bids

Cardinal notes the recent extension by Nordgold on 15 October 2020 of its unconditional on-market A$0.90 per share offer ("Nordgold Offer") to the close of trading on the ASX on 3 November 2020 (unless further extended or withdrawn).

Cardinal also notes the Second Supplementary Bidder's Statement lodged by Shandong Gold on 19 October 2020 in relation to its recommended and unconditional off-market A$1.00 per share takeover offer ("Shandong Gold Offer"). Pursuant to the Second Supplementary Bidder's Statement, Shandong Gold has now declared the A$1.00 cash per share offered to be Shandong Gold's best and final offer price in the absence of a higher competing offer. The practical effect of this statement is that unless there is a higher competing offer to the Shandong Gold Offer (whether from Nordgold or a third party), Shandong Gold cannot increase its offer price.

The Nordgold Offer continues to be materially inferior to the A$1.00 cash per share offered by the Shandong Gold Offer. Cardinal notes that while Nordgold has the right to continue to extend the Nordgold Offer, the most recent extension announcement is the 4th successive extension by Nordgold as the "Underbidder" and the 2nd extension following the Shandong Gold Offer becoming unconditional.

Cardinal considers that the lack of any price increase or any other updated guidance from Nordgold as to its current intentions with respect to Cardinal will result in unwarranted delays to the progression of the Namdini Gold Project and will continue to frustrate the decision making process of Cardinal's shareholders.

Over 7 months have elapsed since the initial unsolicited, indicative, conditional and non-binding proposal from Nordgold was originally received in March 2020 when Cardinal's share price was trading at a 3 year low during the early stages of the COVID 19 pandemic.

Cardinal's permitted Namdini Gold Project is ready for development. Cardinal's 2019 feasibility study has shown the superior economics of the Namdini Gold Project using a USD$1,350 gold price (without taking into account the far stronger gold price at present). Work on the ground and detailed engineering works are poised to commence. The Government of Ghana continues to be fully supportive of moving the Namdini Gold Project towards production and, being a permitted project, progress is now vital.

Cardinal makes the following key observations in respect of the competing takeover offers for Cardinal shareholders to consider at present:

o As Shandong Gold has now declared the A$1.00 cash per share offered by the Shandong Gold Offer to be Shandong Gold's best and final offer price, unless there is a higher competing offer for Cardinal (whether from Nordgold or a third party), Shandong Gold cannot increase its offer price;

o Any Cardinal shareholder who accepts the Shandong Gold "off-market" takeover offer will benefit from any potential increase in offer price which may be made by Shandong Gold, should Shandong Gold increase its offer price prior to the close of its offer - Cardinal does not know if Shandong Gold will increase its offer price, but Shandong Gold has reserved its right to do so in its agreement with Cardinal;

o Any Cardinal shareholder who accepts Nordgold's takeover offer will not benefit from any potential future increase in the offer price offered by Nordgold (as such shares will have been sold "on-market")

- this means that a decision to accept the Nordgold Offer locks in the final return that a Cardinal Shareholder will receive for their shares;

o Following the most recent extension by Nordgold as the "Underbidder", the Nordgold Offer is currently scheduled to close at the close of trading on ASX on 3 November 2020 (unless extended or withdrawn).

If Nordgold wishes to extend the offer period of the Nordgold Offer, then (unless certain special cases apply) Nordgold must do so before the last five trading days of its offer period (currently, the end of trading on 27 October 2020, unless extended).

o The Shandong Gold Offer, unanimously recommended by the Cardinal Board, is unconditional and is currently scheduled to close at 7pm (Sydney time / AEDT) on 23 October 2020 (unless extended or withdrawn). If Shandong Gold wishes to extend the Shandong Gold Offer, then Shandong Gold may do so at any time before the Shandong Gold Offer closes; and

o Under the Bid Implementation Agreement (as varied) with Shandong Gold and Shandong Gold Mining Co., Ltd., Shandong Gold has "matching rights" which provide Shandong Gold with a brief period of time to provide a matching or superior offer to any competing transaction made for Cardinal by any other party. In the event the "matching right" is triggered, Cardinal will keep shareholders advised on the outcome of that event.

Update on Shandong Gold Offer

The highest offer presently made to Cardinal shareholders, and unanimously supported by the Cardinal Board, is A$1.00 cash per share, offered by Shandong Gold. On 19 October 2020, Shandong Gold declared its offer to be best and final in the absence of a higher competing offer. Shandong Gold has acquired a Relevant Interest of 11.86% in Cardinal based on its most recent regulatory filing at the time of this announcement. The Shandong Gold Offer is currently scheduled to close at 7pm (Sydney time) on 23 October 2020 (unless extended or withdrawn).

Update on Nordgold Offer

Nordgold is offering Cardinal shareholders a price of A$0.90 cash per share pursuant to its unconditional onmarket takeover offer. Nordgold has acquired a Relevant Interest of 28.39% in Cardinal based on its most recent regulatory filing at the time of this announcement. Following the most recent extension announcement by Nordgold on 15 October 2020, the Nordgold Offer is currently scheduled to close at the close of trading on ASX on 3 November 2020 (unless extended or withdrawn). If Nordgold wishes to extend the offer period of the Nordgold Offer, then (unless certain special cases apply) Nordgold must do so before the last five trading days of its offer period (currently, the end of trading on 27 October 2020, unless extended).

The Cardinal Board continues to unanimously recommend that Cardinal Shareholders ACCEPT the Shandong Gold Offer (in the absence of a Superior Proposal) and TAKE NO ACTION in respect of the Nordgold Offer.

Advisors

Cardinal's joint financial advisers are Maxit Capital LP, BMO Capital Markets, Euroz Hartleys Limited and Canaccord Genuity Corp. Cardinal's legal advisers are HopgoodGanim Lawyers (Australia) and Bennett Jones LLP (Canada).

About Cardinal Resources Ltd

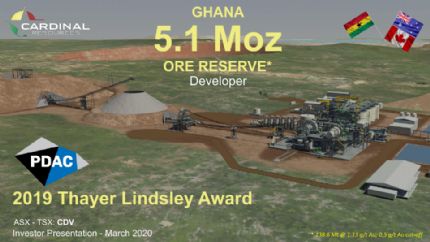

Cardinal Resources Ltd (ASX:CDV) (TSE:CDV) (OTCMKTS:CRDNF) is a West African gold exploration and development Company that holds interests in tenements within Ghana, West Africa.

Cardinal Resources Ltd (ASX:CDV) (TSE:CDV) (OTCMKTS:CRDNF) is a West African gold exploration and development Company that holds interests in tenements within Ghana, West Africa.

The Company is focused on the development of the Namdini Project with a gold Ore Reserve of 5.1Moz (0.4 Moz Proved and 4.7 Moz Probable) and a soon to be completed Feasibility Study.

Exploration programmes are also underway at the Company's Bolgatanga (Northern Ghana) and Subranum (Southern Ghana) Projects.

Cardinal confirms that it is not aware of any new information or data that materially affects the information included in its announcement of the Ore Reserve of 3 April 2019. All material assumptions and technical parameters underpinning this estimate continue to apply and have not materially changed.

| ||

|