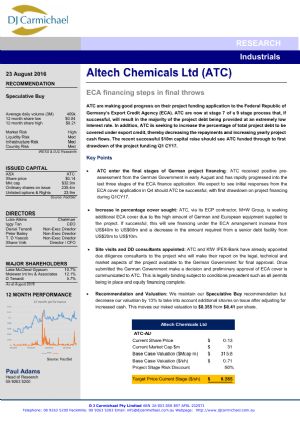

Altech Advance Materials AG Fund Raising Update

Perth, Dec 2, 2019 AEST (ABN Newswire) - Altech Chemicals Limited ( ASX:ATC) (

ASX:ATC) ( A3Y:FRA) in conjunction with Altech Advanced Materials AG (AAM) is pleased to announce that the German corporate regulator BaFin (Federal Financial Supervisory Authority) has approved AAM's Capital Increase Prospectus.

A3Y:FRA) in conjunction with Altech Advanced Materials AG (AAM) is pleased to announce that the German corporate regulator BaFin (Federal Financial Supervisory Authority) has approved AAM's Capital Increase Prospectus.

Highlights

- AAM is aiming to raise approximately US$100 million of new equity

- First phase is a Capital Increase of up to EUR69.4 million (fully subscribed)

- Capital Increase Prospectus approved by BaFin

- Subscription period open from 3 to 16 December 2019

AAM is aiming to raise approximately US$100 million of new equity, which if successful would position it to exercise its option to acquire up to a 49% interest in Altech's high purity alumina (HPA) project. As part of AAMs funding strategy, AAM shareholders have approved for it to issue up to 63,102,080 new shares, which would raise EUR69.4 million fully subscribed at an issue price of EUR1.10 per share (the Capital Increase). AAM was required to prepare a Capital Increase Prospectus which is now approved and the Capital Increase can proceed.

The Capital Increase will be conducted in two phases, the first phase will be a 1:40 rights issue offer to current shareholders (who may also take-up any unsubscribed rights not taken by existing shareholders), this will be followed by a placement of any remaining unsubscribed rights to external investors.

The subscription period will run from 3 December to 16 December 2019.

Capital Increase process

The process that AAM must now follow is:

- firstly, the new shares will be offered to AAM's existing shareholders for subscription at a ratio of 1:40, i.e. for each 1 existing share the holder is entitled to subscribe to 40 new shares at a subscription price of EUR1.10 per share;

- any new shares not subscribed (the "oversubscription shares") may then be subscribed by those existing shareholders that have subscribed for all of the new shares to which they were entitled in accordance with their 1:40 subscription rights. The allocation of the oversubscription shares shall take place at least at the issue price of EUR1.10 per share; and

- any remaining unsubscribed shares can then be placed, at least at the issue price of EUR1.10 but aiming at a price of EUR1.20 per share or higher, to others that are currently not AAM shareholders.

The prescribed timetable for the Capital Increase, which is contained in the AAM Prospectus is:

2019/11/29 Approval of the Prospectus by the German Federal Financial Supervisory Authority (Bundesanstalt fur Finanzdienstleistungsaufsicht, "BaFin") Publication of the Prospectus on the Company's website

2019/12/02 Publication of Subscription Offer in the German Federal Gazette (Bundesanzeiger)

2019/12/02 Book-entry delivery of the subscription rights of the Company's shareholders

2019/12/03 Commencement of the subscription period

2019/12/16 End of the subscription period and last date for payment of the subscription price

2019/12/17 to Placement of the new shares not subscribed for during the subscription period including

2019/12/19 the oversubscription.

2019/12/20 Announcement of the results of the offering on the Company's website

2019/12/30 Registration of the consummation of the capital increase with the Commercial Register

2020/01/07 Book-entry delivery of the new shares

2020/01/10 Admission of the Admission Shares to the regulated market segment (regulierter Market) of the Frankfurt Stock Exchange (Frankfurter Wertpapierborse) segment General Standard

2020/01/13 Settlement of the new shares

First day of trading for the Admission Shares at the regulated market segment (regulierter Markt) of the Frankfurt Stock Exchange (Frankfurter Wertpapierborse) segment General Standard

About Altech Batteries Ltd

Altech Batteries Limited (ASX:ATC) (FRA:A3Y) is a specialty battery technology company that has a joint venture agreement with world leading German battery institute Fraunhofer IKTS ("Fraunhofer") to commercialise the revolutionary CERENERGY(R) Sodium Alumina Solid State (SAS) Battery. CERENERGY(R) batteries are the game-changing alternative to lithium-ion batteries. CERENERGY(R) batteries are fire and explosion-proof; have a life span of more than 15 years and operate in extreme cold and desert climates. The battery technology uses table salt and is lithium-free; cobalt-free; graphite-free; and copper-free, eliminating exposure to critical metal price rises and supply chain concerns.

Altech Batteries Limited (ASX:ATC) (FRA:A3Y) is a specialty battery technology company that has a joint venture agreement with world leading German battery institute Fraunhofer IKTS ("Fraunhofer") to commercialise the revolutionary CERENERGY(R) Sodium Alumina Solid State (SAS) Battery. CERENERGY(R) batteries are the game-changing alternative to lithium-ion batteries. CERENERGY(R) batteries are fire and explosion-proof; have a life span of more than 15 years and operate in extreme cold and desert climates. The battery technology uses table salt and is lithium-free; cobalt-free; graphite-free; and copper-free, eliminating exposure to critical metal price rises and supply chain concerns.

The joint venture is commercialising its CERENERGY(R) battery, with plans to construct a 100MWh production facility on Altech's land in Saxony, Germany. The facility intends to produce CERENERGY(R) battery modules to provide grid storage solutions to the market.

| ||

|