Sydney, Aug 15, 2018 AEST (ABN Newswire) - Lithium Australia ( ASX:LIT) is perhaps best known for its SiLeach(R) hydrometallurgical technology. SiLeach(R) is an alternative to the more common method of converting lithium concentrate to a lithium carbonate via processes that involve energy-intensive roasting.

ASX:LIT) is perhaps best known for its SiLeach(R) hydrometallurgical technology. SiLeach(R) is an alternative to the more common method of converting lithium concentrate to a lithium carbonate via processes that involve energy-intensive roasting.

While SiLeach(R) remains the cornerstone of Lithium Australia's business strategy (first lithium carbonate production from the pilot plant is expected by 2020), the company recently expanded its business model to embrace other aspects of the lithium production cycle. This involves the following.

Sadisdorf lithium project - located in Germany, the project is being advanced towards a scoping study (4Q18). The plan is to process hard-rock lithium ore from Sadisdorf into a lithium carbonate concentrate using SiLeach(R).

VSPC Ltd - a wholly-owned subsidiary of Lithium Australia, VSPC uses proprietary nanotechnology to convert lithium carbonate into a more valuable product: lithium cathode material.

RCARC Ltd - having identified an escalating need for more, and better, recycling of lithium-ion batteries, Lithium Australia subsidiary RCARC aims to recover not only lithium but also other valuable energy metals (including copper, nickel and, most notably, cobalt) from such batteries at the end of their useful life.

Analyst comments: Demand for lithium and other energy metals is now well documented and shows no signs of slowing down. Much of that demand relates to the manufacture of electric vehicles, as well the need for storage of renewable energy, both of which are burgeoning in light of somewhat aggressive government emission targets globally.

At present, investors' exposure to the lithium sector relates mostly to mining ventures that aim, ultimately, to produce and market lithium concentrate. Currently that product sells for between US$500 and US$800 a tonne.

Lithium Australia is taking a different approach: controlling the lithium production cycle right from the mine site (Sadisdorf), through production of lithium concentrate (SiLeach(R)) to, finally, the production and sale of more valuable cathode materials (VSPC) direct to battery manufacturers.

Overall, this strategy reduces Lithium Australia's risk profile, since it need not rely on the success of its SiLeach(R) technology alone. Nor need it rely on third-party agreements for source material, which further enhances its autonomy.

To view the video, please visit:

http://www.abnnewswire.net/press/en/94225/LIT

About Lithium Australia NL

Lithium Australia NL (ASX:LIT) aspires to 'close the loop' on the energy-metal cycle. Its disruptive technologies are designed to furnish the lithium battery industry with ethical and sustainable supply solutions. Lithium Australia’s technology comprises the SiLeach(R) and LieNA(R) lithium extraction processes, along with superior cathode material production courtesy of VSPC Ltd (a wholly owned subsidiary of Lithium Australia) and enhanced recycling techniques for battery materials. By uniting resources and the best available technology, Lithium Australia seeks to establish a vertically integrated lithium processing business.

Lithium Australia NL (ASX:LIT) aspires to 'close the loop' on the energy-metal cycle. Its disruptive technologies are designed to furnish the lithium battery industry with ethical and sustainable supply solutions. Lithium Australia’s technology comprises the SiLeach(R) and LieNA(R) lithium extraction processes, along with superior cathode material production courtesy of VSPC Ltd (a wholly owned subsidiary of Lithium Australia) and enhanced recycling techniques for battery materials. By uniting resources and the best available technology, Lithium Australia seeks to establish a vertically integrated lithium processing business.

About The Sophisticated Investor

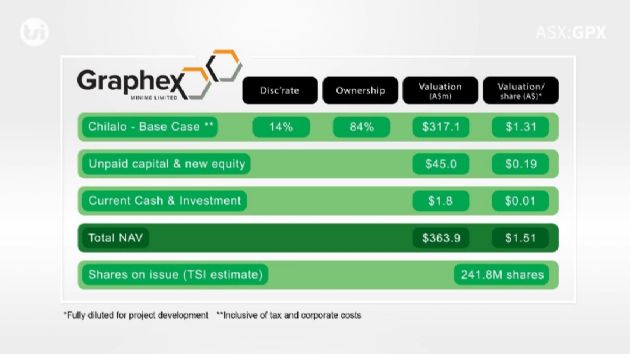

The Sophisticated Investor is a new equity investment tool which seeks to assist investors in becoming more informed in their investment decision making. We show and tell investors about a company in a series of short, informative videos. We possess specialist equity analyst skills and are complemented by video professionals. We conduct site visits and interview management, in a way most investors simply aren’t able to access. We promote long term value creation for investors by employing detailed financial analysis and intrinsic value calculations.

Customer notice

Adam Kiley trading as The Sophisticated Investor ('TSI'), (AR No. 458224), is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359). The information contained in this communication is intended as general advice only. Your personal objectives, financial situation and needs have not been taken into consideration. Accordingly, you should consider how appropriate the advice is (or is not) to your objectives, financial situation and needs before acting on the advice. The information in this communication should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Conflict of interest

TSI does and seeks to do business with companies featured in its articles and videos. As a result, investors should be aware that TSI may have a conflict of interest that could affect the objectivity of some articles or videos. Investors should consider TSI articles and videos as only a single factor in making any investment decision. The publishers also wish to disclose that they may hold stock in some companies featured in their articles and videos, and that any decision you make to purchase the stock of a company TSI profiles should be made only after you have initiated your own enquiries as to the validity of any information contained in those articles and videos.

Publisher's note

TSI will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist, we will initiate coverage of that company and follow up with ongoing updates and commentary on its activities. Articles and videos produced and published by TSI are NOT Research Reports in terms of ASIC Regulatory Guide 79.

| ||

|