Raises $10m in Oversubscribed Placement

Raises $10m in Oversubscribed Placement

Perth, Jan 31, 2018 AEST (ABN Newswire) - Prospect Resources Limited ( ASX:PSC) ("Prospect" or the "Company") is pleased to announce the completion of an oversubscribed placement of 166m shares at an issue price of 6c per share to institutional and sophisticated investors, to raise $10m (before costs).

ASX:PSC) ("Prospect" or the "Company") is pleased to announce the completion of an oversubscribed placement of 166m shares at an issue price of 6c per share to institutional and sophisticated investors, to raise $10m (before costs).

Highlights

- Prospect raises $10m via the issue of 166m shares at 6c per share ("Placement").

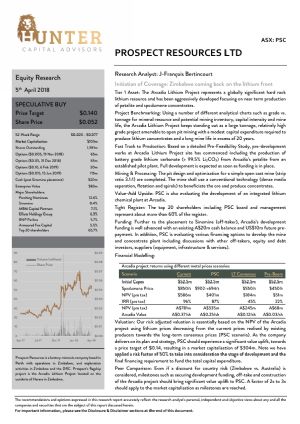

- Hunter Capital Advisors Pty Ltd acted as sole lead manager to the Placement.

- Proceeds of the Placement to be used to:

o accelerate the development of the Arcadia Mine;

o progress exploration at the Good Days Lithium Project (under option);

o investigate and possibly acquire additional lithium and cobalt projects; and

o supplement general working capital.

The proceeds from the Placement are expected to enable Prospect to accelerate the development of the Arcadia Lithium Project and take advantage of the support offered by the new Zimbabwe Government under its Rapid Response Initiative. We look forward to attending and promoting Prospect and our Arcadia Lithium Project at the African Mining Indaba in Cape Town next week.

The Placement will be completed by utilising the Company's existing capacity under ASX Listing Rules 7.1 (6,253,838 shares) and 7.1A (160,412,829 shares). The issue price of 6 cents represents a discount of 5.3% to the 15 day VWAP of the Company's shares.

Hunter Capital Advisors Pty Ltd has acted as sole lead manager to the issue which is scheduled to settle in full on Monday, 5 February 2018.

About Prospect Resources Ltd

Prospect Resources Limited (ASX:PSC) is based in Australasia with operations in Zimbabwe and is a publicly listed company. We are committed to creating value for Prospect's shareholders and the communities in which our company operates. Our vision is to build a Southern African based mining company of international scale.

Prospect Resources Limited (ASX:PSC) is based in Australasia with operations in Zimbabwe and is a publicly listed company. We are committed to creating value for Prospect's shareholders and the communities in which our company operates. Our vision is to build a Southern African based mining company of international scale.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:PSC) ("Prospect" or the "Company") is pleased to announce the completion of an oversubscribed placement of 166m shares at an issue price of 6c per share to institutional and sophisticated investors, to raise $10m (before costs).

ASX:PSC) ("Prospect" or the "Company") is pleased to announce the completion of an oversubscribed placement of 166m shares at an issue price of 6c per share to institutional and sophisticated investors, to raise $10m (before costs).  Prospect Resources Limited (ASX:PSC) is based in Australasia with operations in Zimbabwe and is a publicly listed company. We are committed to creating value for Prospect's shareholders and the communities in which our company operates. Our vision is to build a Southern African based mining company of international scale.

Prospect Resources Limited (ASX:PSC) is based in Australasia with operations in Zimbabwe and is a publicly listed company. We are committed to creating value for Prospect's shareholders and the communities in which our company operates. Our vision is to build a Southern African based mining company of international scale.