Perth, Aug 24, 2017 AEST (ABN Newswire) - Australian Potash ( ASX:APC) is developing the Lake Wells Sulphate of Potash (SOP) Project in the North-Eastern Goldfields of Western Australia. The project is on track to potentially become the first producing Potash Project in Australia.

ASX:APC) is developing the Lake Wells Sulphate of Potash (SOP) Project in the North-Eastern Goldfields of Western Australia. The project is on track to potentially become the first producing Potash Project in Australia.

The company completed a positive Scoping Study in early 2017, which outlined a long life, low capital, Sulphate of Potash operation, initial production 150,000tpa, before doubling production to 300,000tpa in the future. The Company is currently working towards a Feasibility Study which will be released in early 2018, with project financing and development to commence later that year. First production from Lake Wells is targeted for 2020.

Analyst comment: Less than 5 years ago it was thought there was no significant potash deposits in Australia. Since that time a number of highly prospective regions were identified, which subsequently resulted in the discovery and early stage development of a number of Sulphate of Potash Projects, including Australian Potash's lake Wells Project.

Unfortunately, due to limited global demand for SOP, we believe it's unlikely all of the current Australian developers will commence production in the near term.

However due to a number of unique and critical aspects, we believe Australian Potash's Lake Wells Project is potentially ahead of their peers in the race towards production. Firstly, they have the lowest initial capital cost of the peer group, due to the significant existing infrastructure that Lake Wells can utilise. Secondly, it will be the only project to extract potash exclusively via bore field pumps (proven and tested method), whilst finally, it's the only project not subject to a native title claim, which is potentially a significant advantage given lake can be culturally sensitive areas.

The information in this email should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

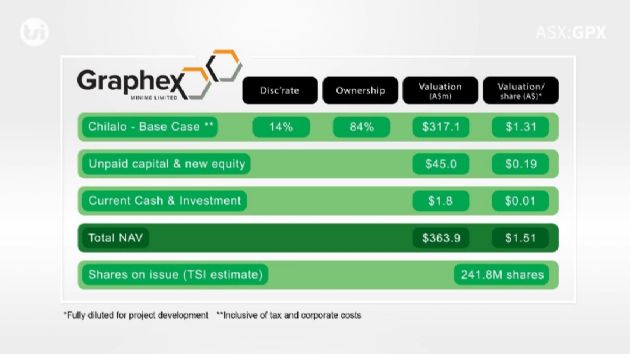

Valuation: We initiate coverage on Australian Potash with a valuation of $0.37 / share (SP - $0.10 / share).

As always, we present our analysis differently as it is shown through a series of videos. This allows us to explain:

- Our investment, risk, peer and valuation analysis which allows us to highlight both upside and downside factors investors should be aware of;

- Review of the Potash industry, highlighting its uses, supply and demand factors as well as pricing;

- A virtual site trip to the Australian Potash's Lake Wells Project; and

- A series of management interviews where we discuss the processing method, native title and Non-binding off-take agreements with two Chinese parties.

To view the video, please visit:

http://www.abnnewswire.net/press/en/89697/apc

About Australian Potash Ltd

Australian Potash Limited (ASX:APC) is an ASX-listed Sulphate of Potash (SOP) developer. The Company holds a 100% interest in the Lake Wells Potash Project located approximately 500kms northeast of Kalgoorlie, in Western Australia's Eastern Goldfields.

Following the release of a Scoping Study in 2017, APC has been conducting a Definitive Feasibility Study (DFS) into the development of the Lake Wells Potash Project. The Company is aiming to release the findings of the DFS in H2 2019.

The Lake Wells Potash Project is a palaeochannel brine hosted sulphate of potash project. Palaeochannel bore fields supply large volumes of brine to many existing mining operations throughout Western Australia, and this technique is a well understood and proven method for extracting brine. APC will use this technically low-risk and commonly used brine extraction model to further develop a bore-field into the palaeochannel hosting the Lake Wells SOP resource.

A Scoping Study on the Lake Wells Potash Project was completed and released on 23 March 2017. The Scoping Study exceeded expectations and confirmed that the Project's economic and technical aspects are all exceptionally strong, and highlights APC's potential to become a significant long-life, low capital and high margin sulphate of potash (SOP) producer.

About The Sophisticated Investor

The Sophisticated Investor is a new equity investment tool which seeks to assist investors in becoming more informed in their investment decision making. We show and tell investors about a company in a series of short, informative videos. We possess specialist equity analyst skills and are complemented by video professionals. We conduct site visits and interview management, in a way most investors simply aren’t able to access. We promote long term value creation for investors by employing detailed financial analysis and intrinsic value calculations.

Customer notice

Adam Kiley trading as The Sophisticated Investor ('TSI'), (AR No. 458224), is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359). The information contained in this communication is intended as general advice only. Your personal objectives, financial situation and needs have not been taken into consideration. Accordingly, you should consider how appropriate the advice is (or is not) to your objectives, financial situation and needs before acting on the advice. The information in this communication should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Conflict of interest

TSI does and seeks to do business with companies featured in its articles and videos. As a result, investors should be aware that TSI may have a conflict of interest that could affect the objectivity of some articles or videos. Investors should consider TSI articles and videos as only a single factor in making any investment decision. The publishers also wish to disclose that they may hold stock in some companies featured in their articles and videos, and that any decision you make to purchase the stock of a company TSI profiles should be made only after you have initiated your own enquiries as to the validity of any information contained in those articles and videos.

Publisher's note

TSI will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist, we will initiate coverage of that company and follow up with ongoing updates and commentary on its activities. Articles and videos produced and published by TSI are NOT Research Reports in terms of ASIC Regulatory Guide 79.

| ||

|