Arcadia PFS Completed and Lithium Chemical Plant PFS Underway

Presentation - Summary of Arcadia Pre-Feasibility Study

Presentation - Summary of Arcadia Pre-Feasibility Study

Perth, July 11, 2017 AEST (ABN Newswire) - Prospect Resources Ltd ( ASX:PSC) provides the Company's latest Investor Presentation - Summary of Arcadia Pre-Feasibility Study.

ASX:PSC) provides the Company's latest Investor Presentation - Summary of Arcadia Pre-Feasibility Study.

Corporate & Project Snapshot

Prospect Resources Limited ( ASX:PSC) - Developing the Arcadia Lithium Deposit in Zimbabwe

ASX:PSC) - Developing the Arcadia Lithium Deposit in Zimbabwe

- Cash OPEX US$ 320/t conc.

- Low CAPEX of US$ 52.5 M

- Average annual production of:

o 75 000t spodumene concentrate (6% Li2O)

o 155 000t petalite concentrate (4.1% Li2O)

o 88 000lb contained tantalite in concentrate (>25% Ta2O5)

Arcadia Lithium Project Location

- 35km East of Harare

- Mining friendly jurisdiction

- Excellent access to infrastructure, including roads, rail, power and skilled labour

- <20km gravel road to sealed highway & railhead to Beira, 450km away

- Mining and Environmental Approvals in place

- Abundant groundwater available

- Surface rights secured by Prospect and being developed for agriculture

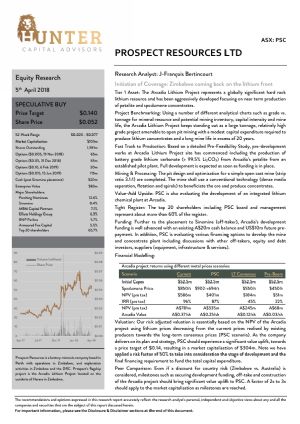

Arcadia PFS Highlights

- Maiden Ore Reserve of 15.8Mt @ 1.34% Li2O & 125ppm Ta2O5

- Pit Inventory of 23.7Mt @ 1.34% Li2O & 124ppm Ta2O5

- Life of Mine of 20 years with a strip ratio of 2.79:1

- NPV10 of USD 139 Million, IRR of 39% and payback of 2 years

- LOM Revenue ~ USD 2 Billion

- Cash Operating Cost of USD 320/t conc.

- Low CAPEX/start up of USD 52.5 Million

Arcadia Lithium Project - CAPEX & OPEX

CAPEX

- Construction of 1.2Mtpa mine, plant and infrastructure estimated at USD 52.5 Million

- Costing based on local experience and independent consultants

OPEX

- Total OPEX USD 66/t ore milled

- USD 320/t lithium concentrate (inclusive of freight & port delivery charges to China)

Arcadia Lithium Project -Processing & Logistics

- Extensive metallurgical testwork completed

- Total recoveries 71%, process optimisation continues

- Simple open pit, and short haul to comminution and process plant

- Sufficient ground and surface water with grid power <3km away

Arcadia Financial Evaluation & Risk Assessment

- PFS pricing assumptions considered conservative

o 6% Li2O Spodumene Concentrate -USD 540/t

o 4.1% Li2O Petalite Concentrate -USD 400/t

Arcadia Lithium - Market/Sales/Chemical Plant

Lithium Market

- Lithium Market remains in supply deficit reflected in increases in lithium mineral and chemical prices

- Arcadia is expected to be one of the early new suppliers of lithium to world markets

Arcadia Sales Volumes

- Arcadia set to annually produce:

o >75,000t spodumene concentrate (6% Li2O)

o >155,000t petalite concentrate (4.1% Li2O)

o 88,000 lb contained tantalite in concentrate (>25% Ta2O5)

Lithium Chemical Plant -lithium carbonate and lithium hydroxide

- PFS underway to develop a lithium chemical plant at Arcadia

- Only lithium chemical plant outside Australasia

- Value add through downstream high value lithium products

- Geographically well placed to serve European, North American and Asian Markets

To view the full presentation, please visit:

http://abnnewswire.net/lnk/6F068KT2

About Prospect Resources Ltd

Prospect Resources Limited (ASX:PSC) is based in Australasia with operations in Zimbabwe and is a publicly listed company. We are committed to creating value for Prospect's shareholders and the communities in which our company operates. Our vision is to build a Southern African based mining company of international scale.

Prospect Resources Limited (ASX:PSC) is based in Australasia with operations in Zimbabwe and is a publicly listed company. We are committed to creating value for Prospect's shareholders and the communities in which our company operates. Our vision is to build a Southern African based mining company of international scale.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:PSC) provides the Company's latest Investor Presentation - Summary of Arcadia Pre-Feasibility Study.

ASX:PSC) provides the Company's latest Investor Presentation - Summary of Arcadia Pre-Feasibility Study.  ASX:PSC) - Developing the Arcadia Lithium Deposit in Zimbabwe

ASX:PSC) - Developing the Arcadia Lithium Deposit in Zimbabwe  Prospect Resources Limited (ASX:PSC) is based in Australasia with operations in Zimbabwe and is a publicly listed company. We are committed to creating value for Prospect's shareholders and the communities in which our company operates. Our vision is to build a Southern African based mining company of international scale.

Prospect Resources Limited (ASX:PSC) is based in Australasia with operations in Zimbabwe and is a publicly listed company. We are committed to creating value for Prospect's shareholders and the communities in which our company operates. Our vision is to build a Southern African based mining company of international scale.