State Gas Strategic Review

Brisbane, May 2, 2022 AEST (ABN Newswire) - State Gas Limited ( ASX:GAS) notes the recent record increase in the price of liquefied natural gas (LNG) amid the Russia-Ukraine conflict and the sanctions on imports of Russian energy imposed by several countries, including Canada, the United Kingdom, and the United States.

ASX:GAS) notes the recent record increase in the price of liquefied natural gas (LNG) amid the Russia-Ukraine conflict and the sanctions on imports of Russian energy imposed by several countries, including Canada, the United Kingdom, and the United States.

The World Bank's Commodity Markets Outlook Report released in April explains that war in Ukraine has dealt a major shock to commodity markets, altering global patterns of trade, production, and consumption in ways that will keep prices at historically high levels through the end of 2024. The long-term outlook for commodity markets depends heavily on the duration of the war in Ukraine and the extent of sanctions, with a material risk that energy prices could increase much more than forecast, especially if EU sanctions on Russian energy are broadened.

The World Bank also noted that previous energy price hikes led to the emergence of new sources of supply, and that changes in commodity trade patterns are expected to continue even after the war ends.

In light of the sustained high LNG prices and medium-term forecasts exacerbated by the war in Ukraine, State Gas has conducted a strategic review of its Central Queensland assets to determine the most cost effective and quickest route to market for its gas.

Critical in this regard are the following key factors:

- Gas produced from any part of the Company's acreage is able to be freely sold into the domestic market or exported (i.e. not subject to domestic gas reservation policies);

- Gas from each of the Company's 100%-owned projects is currently uncommitted; and

- Conventional gas from the northern area of PL231 (the Primero/Aldinga resource) and the coal seam gas at Rougemont in nearby ATP 2062 is essentially of pipeline quality, requiring only dehydration and compression to meet deliverability requirements.

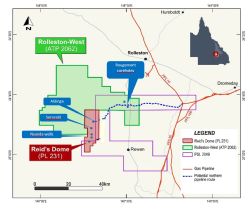

The preferred pipeline route identified is to the north and east through both Aldinga and Rougemont to connect to the main Queensland gas trunk line (see map below*).

Accordingly, State Gas has decided to prioritise the development of the conventional gas around Aldinga through a pipeline traversing the Rougemont field to the Rolleston compressor station.

Desktop studies have identified Aldinga to Rougemont as the optimal initial development plan, with the Nyanda area south of Aldinga to be developed as a subsequent phase. Initial field surveys are planned for next month.

In relation to the Rougemont gas area, nearby analogues for the development of the Bandanna coals show that horizontal drilling substantially lessens the time to peak production whilst materially elevating the peak production rate. State Gas therefore intends to drill a horizontal well into the two thickest seams that will intersect the existing Rougemont 2 vertical well.

Planning for this horizontal well is underway, with drilling expected during the coming Quarter.

State gas expects a first pass economic review to be completed in the third quarter of this calendar year and, depending on the outcomes of production testing of the proposed horizontal well at Rougemont, may then be in a position to apply for a pipeline licence with the aim of accelerating gas sales.

*To view Map showing location of permits, please visit:

https://abnnewswire.net/lnk/628JC0HE

About State Gas Limited

State Gas Limited (ASX:GAS) is a Queensland-based developer of the Reid's Dome gas field, originally discovered during drilling in 1955, located in the Bowen Basin in Central Queensland. State Gas is 100%-owner of the Reid's Dome Gas Project (PL-231) a CSG and conventional gas play, which is well-located 30 kilometres southwest of Rolleston, approximately 50 kilometres from the Queensland Gas Pipeline and interconnected east coast gas network.

State Gas Limited (ASX:GAS) is a Queensland-based developer of the Reid's Dome gas field, originally discovered during drilling in 1955, located in the Bowen Basin in Central Queensland. State Gas is 100%-owner of the Reid's Dome Gas Project (PL-231) a CSG and conventional gas play, which is well-located 30 kilometres southwest of Rolleston, approximately 50 kilometres from the Queensland Gas Pipeline and interconnected east coast gas network.

Permian coal measures within the Reid's Dome Beds are extensive across the entire permit but the area had not been explored for coal seam gas prior to State Gas' ownership. In late 2018 State Gas drilled the first coal seam gas well in the region (Nyanda-4) into the Reid's Dome Beds and established the potential for a significant coal seam gas project in PL 231. The extension of the coal measures into the northern and central areas of the permit was confirmed in late 2019 by the Company's drilling of Aldinga East-1A (12 km north) and Serocold-1 (6 km to the north of Nyanda-4).

State Gas is also the 100% holder Authority to Prospect 2062 ("Rolleston-West"), a 1,414 km2 permit (eight times larger than PL 231) that is contiguous with the Reid's Dome Gas Project. Rolleston-West contains highly prospective targets for both coal seam gas (CSG) and known conventional gas within the permit area. It is not restricted by domestic gas reservation requirements.

The contiguous areas (Reid's Dome and Rolleston-West), under sole ownership by State Gas, enable integration of activities and a unified super-gasfield development, providing economies of scale, efficient operations, and optionality in marketing.

State Gas is implementing its strategic plan to bring gas to market from Reid's Dome and Rolleston-West to meet near term forecast shortfalls in the east coast domestic gas market. The strategy involves progressing a phased appraisal program in parallel with permitting for an export pipeline and development facilities to facilitate the fastest possible delivery of gas to market. State Gas' current focus has been to confirm the producibility of the gas through production testing of the wells.

| ||

|