Company Update

Perth, May 4, 2020 AEST (ABN Newswire) - Cardinal Resources Limited ( ASX:CDV) (

ASX:CDV) ( C3L:FRA) (

C3L:FRA) ( CRDNF:OTCMKTS) (

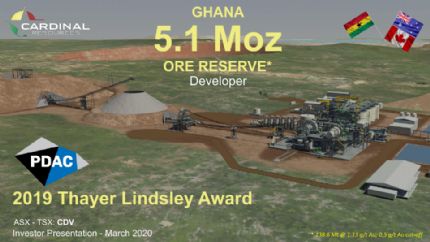

CRDNF:OTCMKTS) ( TSE:CDV) is pleased to provide an update in relation to the development of its 5.1Moz* Namdini Gold Project in Ghana, West Africa.

TSE:CDV) is pleased to provide an update in relation to the development of its 5.1Moz* Namdini Gold Project in Ghana, West Africa.

Project Permits and Approval Status

- July 2018 - Environmental Impact Statement (EIS) development and documentation process initiated

- December 2019 - Cardinal submitted its Draft EIS for development of the Namdini Project with Ghanaian EPA

- January 2020 - Ghanaian Environmental Protection Agency (EPA) completed its review of the Draft Environmental Impact Statement (EIS) for the development of the Namdini Project. The EIS was revised as needed and re-submitted in March 2020

- February 2020 - Relocation Action Plan (RAP) was approved. The RAP was developed over an extended period, inclusive of extensive consultation with the Project Affected People (PAP) and several levels of the Government. It was signed off by all PAP and subsequently approved by the Ghanaian Minerals Commission

- February 2020 - Water License was granted. Permits the use of water for construction and mine operations purposes

- April 2020 - Ghanaian EPA approves Cardinal's EIS, granting its Permit for the development of the Namdini Gold Project

Project Fly-Through

The Company has completed a project fly-through at Namdini, this can be viewed on the Company's website at www.cardinalresources.com.au.

Project Economic Outcomes

Following release of the Feasibility Study and accompanying NI43-101 Technical Report (ASX/TSX Press Release dated 28 October and 28 November 2019 respectively) the gold price has traded within the range of USD$1,452 to USD$1,757 per ounce.

The Feasibility Study evaluated the Namdini project outcomes at a gold price of USD$1,350 per ounce, but also presented gold price sensitivities from USD$1,150 per ounce and up to USD$1,550 per ounce which Cardinal has set out below in Table 1 below.

Table 1 - Namdini Project Feasibility Study Outcomes (ASX/TSX Press Release dated 28 October and 28 November 2019 respectively)

Project Financial Model ---------------------------------------------------------Gold Price US$/oz 1,150 1,350 1,550---------------------------------------------------------Capital Cost(including $42M contingency) US$ M 390 390 390---------------------------------------------------------All in Sustaining Costs (AISC)*1 Starter Pit US$/oz 585 585 585Life of Mine (15 years) US$/oz 895 895 895---------------------------------------------------------Total Project Payback months 33 21 9---------------------------------------------------------Pre-Tax NPV5% US$ M 406 914 1,438---------------------------------------------------------Pre-Tax IRR % 26 43 57---------------------------------------------------------

*1 Cash Costs + Royalties + Levies + Life of Mine Sustaining Capital Costs (World Gold Council Standard).

Royalties calculated at a rate of 5.5% at USD$1,350/oz and 6.0% at USD$1,550/oz and a corporate tax rate of 32.5%; both subject to negotiation.

The forecast financial information set out above in Table 1 was initially contained in Cardinal's Feasibility Study (refer Cardinal's ASX Announcement ( ASX:CDV) of 28 October 2019 titled "Feasibility Study Confirms Namdini as Tier One Gold Project". Cardinal confirms that all the material assumptions underpinning the above forecast financial information in the Feasibility Study continue to apply and have not materially changed.

ASX:CDV) of 28 October 2019 titled "Feasibility Study Confirms Namdini as Tier One Gold Project". Cardinal confirms that all the material assumptions underpinning the above forecast financial information in the Feasibility Study continue to apply and have not materially changed.

Corporate Activity

Please refer to the company's announcements of 16 March 2020 and 30 March 2020 in relation to the recent approach from Nord Gold.

The Company continues to work with the Special Purpose Committee to review all strategic alternatives.

COVID-19

There have been no confirmed cases of COVID-19 at any of the Company's sites or offices and a comprehensive response plan is in place to ensure the protection of our staff and contractors. The safety of our people, their families and the communities in which we operate are, and will always be Cardinal's first priority. The challenges of COVID-19 are constantly changing and we remain flexible and united in our responses to maintain staff safety.

All international travel into Ghana remains suspended, while on the ground in Ghana, the workforce has been reduced to key personnel only. Work from home operating procedures have been established where possible while site-based staff continue to operate in limited capacities. Although fieldwork has been scaled back, the Namdini Project Team is still actively working on adding value to the project.

About Cardinal Resources Ltd

Cardinal Resources Ltd (ASX:CDV) (TSE:CDV) (OTCMKTS:CRDNF) is a West African gold exploration and development Company that holds interests in tenements within Ghana, West Africa.

Cardinal Resources Ltd (ASX:CDV) (TSE:CDV) (OTCMKTS:CRDNF) is a West African gold exploration and development Company that holds interests in tenements within Ghana, West Africa.

The Company is focused on the development of the Namdini Project with a gold Ore Reserve of 5.1Moz (0.4 Moz Proved and 4.7 Moz Probable) and a soon to be completed Feasibility Study.

Exploration programmes are also underway at the Company's Bolgatanga (Northern Ghana) and Subranum (Southern Ghana) Projects.

Cardinal confirms that it is not aware of any new information or data that materially affects the information included in its announcement of the Ore Reserve of 3 April 2019. All material assumptions and technical parameters underpinning this estimate continue to apply and have not materially changed.

| ||

|