Measured Vanadium Mineral Resource of 22 Mt at 0.37% V2O5 is in addition to Caula's Graphite Mineral Resource of 5Mt at 13%TGC

Caula Project - Maiden Vanadium Mineral Resource

Caula Project - Maiden Vanadium Mineral Resource

Sydney, July 20, 2018 AEST (ABN Newswire) - Mustang Resources Ltd ( ASX:MUS) (

ASX:MUS) ( GGY:FRA) (

GGY:FRA) ( MTTGF:OTCMKTS) is pleased to announce that its Caula Vanadium-Graphite project in Mozambique has taken another key step towards development with the completion of the maiden JORC-compliant vanadium Mineral Resource estimate.

MTTGF:OTCMKTS) is pleased to announce that its Caula Vanadium-Graphite project in Mozambique has taken another key step towards development with the completion of the maiden JORC-compliant vanadium Mineral Resource estimate.

Key Points

- Total Maiden JORC Resource of 22 Mt @ 0.37% vanadium pentoxide (V2O5) (0.2 % grade cut-off) at the Caula Vanadium-Graphite Project in Mozambique

- The entire Vanadium Resource is in the Measured Resource category

- Vanadium Resource is subdivided into two zones:

o Oxidised Zone - 8.9 Mt @ 0.31% V2O5 for 27,400 tonnes contained V2O5 (0.2% grade cut-off)

o Fresh Zone - 13.1 Mt @ 0.41% V205 for 54,200 tonnes of contained V2O5 (0.2% grade cut-off)

- Total contained V2O5 of 81,600 tonnes (~180 Mlb)

- Current V2O5 price is of US$18.50/lb (US$40,500/tonne) (98% V2O5)

- Substantial scope for further growth in the Vanadium Resource through exploration

- Chinese vanadium demand jumped 15% in May 2018 from April as steel mills prepared to switch to making higher-strength steel(see Note 1 below)

- 3,000t of vanadium used in batteries in 2017, twice as much as reported in 2016(see Note 1 below)

- Following the merger of Mustang's ruby project with Fura, Mustang now ideally positioned to become a leading vanadium and graphite company

The Mineral Resource, which is all in the Measured category, is 22Mt at 0.37% vanadium pentoxide (V2O5) for a total of 81,600 tonnes of contained vanadium pentoxide.

This is in addition to the existing graphite Resource at Caula of 5Mt at 13% Total Graphitic Carbon (TGC). Mustang is currently finalising an updated graphite Mineral Resource estimate.

Mustang Managing Director Dr. Bernard Olivier said the combination of the vanadium and graphite resources shows Caula is rapidly emerging as a highly valuable project.

"This is an exceptional result, with over 81,000 tonnes contained V2O5, particularly given that the entire JORC Resource is in the Measured category," Dr Olivier said.

"With vanadium pentoxide prices running at more than US$40,000 per tonne (98% V2O5), the Caula resource translates to a highly valuable resource.

"Furthermore, the potential of the project is even greater as our vanadium is mica-hosted and associated with the graphite mineralisation and potentially far cheaper to extract and recover through two simple processing steps, compared with most vanadium projects, where the vanadium is located in a complex titaniferous magnetite ore body."

Geology of the Caula Graphite Deposit

The Caula deposit is located in northern Mozambique, the graphite mineralisation is hosted in quartzitic schists of the Xixano Complex. The most common lithologies include Graphitic Schists, Gneisses and thin Pegmatoidal zones. Sulphides are occasionally logged but are usually absent. The surrounding country rock consists of Quarzitic and Micaceous Schists and Gneisses.

The project area is situated in the Mozambique Belt of the East African Orogen, and contains highly metamorphosed meta-sediments and meta-volcanics. The rocks of the East-African Orogen are dated 850 - 620 Ma in which metamorphic facies vary from amphibolitic to granulitic.

The mineralised zone is contained within a reclined isoclinal fold structure which dips at roughly 60 degrees to the west (see Figure 1 in link below). Due to the region's tectonic history these meta-sediments have been altered to the extent that no sedimentary structure remains.

Drilling, Sampling and Sub-sampling Techniques

The drilling program comprised of one RC (reverse Circulation) and 16 DD (Diamond Drilling) boreholes. The initial part of the hole was drilled with PQ (III) until the rock was competent to be drilled with HQ (III). Drill core was orientated wherever possible. The mineralised core was sampled as half (Leco analysis) and quarter (metallurgical test work) core, with the remaining quarter retained in the stratigraphic sequence in the core trays. Appropriate QA/QC samples (standards, blanks, duplicates and umpire samples) are inserted into the sequence as per industry standard.

Sample Analysis

Sample preparation and analysis was completed by SGS in Johannesburg. Sampling procedure which include drying, crushing, splitting and pulverizing ensures that 85% of the sample is 75 micron or less in size. A split of the sample is analysed using a LECO analyser to determine total carbon in graphite (TGC%) content. A second split of the sample is prepared for element analysis by XRF to determine V2O5 content. Rougher and multiple re-grind and cleaner flotation, Final concentrate PSD and fraction assays.

Resource Estimation Methodology

The geological models used for the resource estimation was created in Voxler (Version 4.2.584), a modelling package developed and distributed by Golden Software in Colorado. The deposit was divided into an upper oxidised zone and a lower fresh zone. Once a specific grade volume has been calculated a weighted average density is applied to the volume and a tonnage is determined.

Weighted averaging for sample length was applied. No grade truncations were applied. A cut-off grade of 0.2% has been applied. Grade-tonnage curves were produced and could be used to determine the effect of cut-off grades on remaining mineralised tonnages, but the drilled resource is calculated as intersected in-situ. The calculated grade is weighted for representative mass, as calculated in Voxler.

Cut-off Parameters

A 0.2% V2O5 grade cut-off was applied. The modelling is limited by drilling extent. The drilling have not intersected and hence delineated the outer edge of barren host rock. The physical limits of the mineralisation will be established with additional future drilling.

Grade-tonnage curves were produced (See Figures 2 and 3 in link below) and the influence of various cut-off grades can be investigated. The physical deposit boundaries have not been intersected in the drilling work to date and hence the model is suspended within graphite and roscoelite mineralised rock. The western and northern deposit boundary (at shallow depth), is expected to be fixed with the next phase of drilling. The eastern and southern boundaries are open to at least 200m and several kilometres respectively.

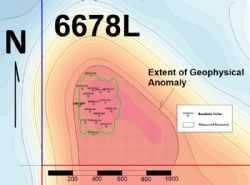

Caula Vanadium Resource Estimate

The Caula Mineral Resource estimate is based on 16 diamond drillholes totalling 2,233.21 metres (484.72m in 2016 and 1,748.49m in 2017) and one reverse circulation (RC) drillhole totalling 99 metres (see Figure 4 in link below). Drillholes are spaced approximately 85 metres apart along a 540 metre strike length. With the exception of drillhole MORC004 (-77deg), all holes were drilled at inclinations of between 55deg and 60deg from the horizontal.

The drillhole samples were submitted to SGS in Randfontein (South Africa) for analyses as well as to SGS (Malaga) and Nagrom, Perth for metallurgical testwork. In total, 1,128 assay results were generated and these were used with the drillhole data to complete the Maiden Vanadium Resource estimate.

Grade estimation was completed using an inverse distance squared method. The deposit was divided into an upper oxidised zone and a lower fresh zone. Points of equal grade within the model boundary are draped with a wireframe shape (of which the anisotropy settings are defined in the gridder module) and the volume for the shape is calculated in Voxler. This is repeated for grades 0.01% V2O5 to 0.65 % V2O5 for the oxidised zone and up to 1.30 % TGC for the fresh zone.

Once a specific grade volume interval had been calculated (by difference) a weighted average density was applied to the volume and a tonnage determined.

The Mineral Resource estimate for the Caula Vanadium Deposit is reported using a cut-off grade of 0.2% V2O5 (vanadium pentoxide). The Measured Mineral Resource totals 22 million tonnes at an average grade of 0.37% V2O5 for 81,600 tonnes of contained V2O5 (vanadium pentoxide).

The results of the Mineral Resource estimate are summarised in Table 1 below (see link below).

Drillhole information and reporting in accordance with the JORC Code 2012 Edition are included as Appendices to this announcement.

The grade-tonnage curve for the oxidised zone is shown in Figure 2 below (see link below). The Oxidised Zone displays the following grade-tonnage relationship: at a cut-off grade of 0.1% V2O5 the deposit will have as a balance 12.6Mt of mineralised tonnes at an average grade of 0.26% V2O5, for 34 000 tonnes of contained graphite. At a cut-off grade of 0.2% V2O5 the deposit will have as a balance 8.9Mt of mineralised tonnes at an average grade of 0.31% V2O5, for 27 400 tonnes of contained graphite. At a cut-off grade of 0.3% V2O5 the deposit will have a balance of 3.9Mt of mineralised tonnes at an average grade of 0.38%, for 14,800 tonnes of contained V2O5.

The grade-tonnage curve for the Fresh Zone is shown in Figure 3 below (see link below). For the Fresh Zone the following relationship is seen from the grade-tonnage curve; At a cut-off grade of 0.1% V2O5 the deposit will have a balance of 17.1Mt mineralised tonnes at an average grade of 0.35% V2O5, for 60 200 tonnes of contained V2O5. At a cut-off grade of 0.2% V2O5 the deposit will have a balance of 13.1Mt mineralised tonnes at an average grade of 0.41% V2O5, for 54 200 tonnes of contained V2O5. At a cut-off grade of 0.3% V2O5 the deposit will have a balance of 9.3Mt mineralised tonnes at an average grade of 0.48%, for 44 900 tonnes of contained V2O5.

Mineral Resource Classification Criteria

The resource is classified as Measured. The core losses in the DD boreholes were assigned 0% V2O5 values as a conservative measure. The CP has no reason to doubt the input data from the core logging to the laboratory results. The estimate is conservative and probably understated in both tonnage and grade.

The surface area of 12.2 Ha is covered by 17 regularly spaced boreholes for an average grid of just less than 85 m squared.

In addition, the geovariance which was calculated over 13 ranges with 24 data-pairs shows a sill distance of 170m. This calculation is based on information from 16 boreholes, and may well change as it gets updated with new drilling information. Based on this geovariance, the drill spacing at an average of 85m is considered to be sufficient to determine a measured resource.

Mining and Metallurgical Methods and Parameters

The resource estimation has assumed that the deposit could potentially be mined using open cut mining techniques. No assumptions have been made for mining dilution or mining widths, however mineralisation is generally broad.

Syrah Resources Ltd ( ASX:SYR) has the Balama graphite project located down-strike on an extension of Caula mineralisation. In 2014 Syrah Resources (ref Syrah Resources "Update on Vanadium Metallurgy" dated 8 April 2014) reported the results of vanadium recovery testwork on their ore. It was noted that that the application of WHIMS and mica flotation processes to the graphite flotation tailings was effective in recovering vanadium and could achieve a combined concentrate grade of > 3% V2O5. Further work showed that commercial grade vanadium pentoxide (>98% Purity) could be produced from this vanadium concentrate.

ASX:SYR) has the Balama graphite project located down-strike on an extension of Caula mineralisation. In 2014 Syrah Resources (ref Syrah Resources "Update on Vanadium Metallurgy" dated 8 April 2014) reported the results of vanadium recovery testwork on their ore. It was noted that that the application of WHIMS and mica flotation processes to the graphite flotation tailings was effective in recovering vanadium and could achieve a combined concentrate grade of > 3% V2O5. Further work showed that commercial grade vanadium pentoxide (>98% Purity) could be produced from this vanadium concentrate.

Mustang's metallurgical testwork conducted to date at Independent Metallurgical Operations Pty Ltd ("IMO") and Nagrom, both located in Western Australia, has shown that the vanadium reports to the tailings during the graphite flotation process. Vanadium recovery testwork on the flotation tailings showed that a portion of the vanadium could be recovered and concentrated by WHIMS (Wet High Intensity Magnetic Separator. Additional vanadium could be recovered from the WHIMS tailings by a froth flotation procedure aimed at recovering and concentrating micaceous minerals including roscoelite. This work is at a preliminary stage but it has demonstrated strong similarities between the Caula and Balama ores. Ongoing testwork is aimed at optimising vanadium recovery and concentrate grade.

Project Area Potential

The Caula Project is located within a world-class graphite province and there is significant potential to expand the maiden Vanadium Resource estimate through ongoing exploration and drilling.

In the immediate vicinity of the Caula discovery, graphite mineralisation has now been defined over a 540m strike length. This mineralisation is up to 230m wide (estimated true thickness) and the depth is completely open-ended at the limit of the current drilling.

A new program of diamond and reverse circulation drilling has been planned to test for both up-dip and down-dip extensions to the Caula deposit in this area.

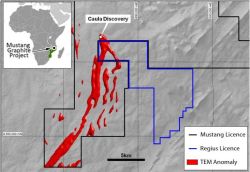

In addition to the potential to define additional graphite and vanadium mineralisation immediately adjacent to the Caula discovery, there is also very strong potential to define high grade graphite mineralisation over the much larger project area.

The Caula discovery is located at the northern end of a suite of large-scale geophysical (TEM) anomalies that extend over an 18km strike length within Mustang's tenements (see Figure 5 in link below). Drilling at the Caula site confirms a strong spatial correlation between the TEM anomaly and high grade graphite drill hole intersections. The larger-scale TEM anomaly has received minimal drilling to date and therefore remains largely untested.

Mustang proposes systematically to drill test the large-scale TEM target through progressive step out drilling from the Caula discovery. This drilling has commenced.

The Company is extremely encouraged by the results received to date from its maiden Vanadium Resource Estimate and the Caula deposit as a whole. The combination of high grade drilling results, positive initial metallurgical testwork, a large V2O5 maiden Measured Resource estimate, large-scale untested exploration targets and the project's location within a demonstrated world-class graphite-vanadium province confirm the project's potential to create significant future value for the Company.

As previously reported, due to unexpected delays in receiving the final vanadium and graphite assay results back from the independent laboratory, the completion of the maiden vanadium resource estimate as well as the upcoming graphite resource update was delayed. The delay further caused a delay in the estimated completion of the Scoping Study to Q3 2018.

Vanadium Pricing and Demand

Worldwide, the major use of vanadium is as an alloying agent in full alloy and high strength low alloy steels. China has recently increased the minimum specification for reinforcing steel used in buildings and as a result, domestic vanadium consumption is expected to increase by 10,000 tonnes per year (Metal Bulletin, August 2017). The vanadium market has already experienced a structural shift, changing China from being a net exporter of vanadium to becoming a net importer of vanadium. The use of vanadium in vanadium redox flow batteries (VRFB batteries), used for large scale energy storage is set to drive a further increase in demand. Consequently, vanadium supplies have tightened and the price of vanadium has increased sharply over the last two years to current levels of US$18.6/lb (~US$40,500/tonne)(see Note 2 below), making it the best performing battery metal of 2017(see Note 3 below). Demand for vanadium is reasonably expected to increase due to demand for use in steel and battery development. Chinese vanadium demand jumped 15% in May over the prior month, as steel mills start preparing for the switch to higher-strength steel(see Note 1 below). In 2017, 3,000t of vanadium was used in batteries, twice as much as reported in 2016, and this feeds into industry forecasts that these figures will at least double again in 2018(see Note 1 below).

Notes:

1 Source: Mining Journal 28 June 2018

2 Based on 18 July 2018 pricing of US$18.6/lb (US$40,500/tonne) for 98% Vanadium pentoxide delivered in China. Source: vanadiumprice.com

3 "Best performing battery metal of the year isn't cobalt", Mark Burton. Bloomberg. January 26, 2018

To view tables and figures, please visit:

http://abnnewswire.net/lnk/B0LJQS24

About New Energy Minerals Ltd

New Energy Minerals Ltd (ASX:NXE) (FRA:GGY) is an ASX listed junior mining company, that recently announced the divestment of the Company's Caula vanadium - graphite project and the Montepuez Ruby project in Mozambique.

New Energy Minerals Ltd (ASX:NXE) (FRA:GGY) is an ASX listed junior mining company, that recently announced the divestment of the Company's Caula vanadium - graphite project and the Montepuez Ruby project in Mozambique.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:MUS) (

ASX:MUS) ( GGY:FRA) (

GGY:FRA) ( MTTGF:OTCMKTS) is pleased to announce that its Caula Vanadium-Graphite project in Mozambique has taken another key step towards development with the completion of the maiden JORC-compliant vanadium Mineral Resource estimate.

MTTGF:OTCMKTS) is pleased to announce that its Caula Vanadium-Graphite project in Mozambique has taken another key step towards development with the completion of the maiden JORC-compliant vanadium Mineral Resource estimate.  ASX:SYR) has the Balama graphite project located down-strike on an extension of Caula mineralisation. In 2014 Syrah Resources (ref Syrah Resources "Update on Vanadium Metallurgy" dated 8 April 2014) reported the results of vanadium recovery testwork on their ore. It was noted that that the application of WHIMS and mica flotation processes to the graphite flotation tailings was effective in recovering vanadium and could achieve a combined concentrate grade of > 3% V2O5. Further work showed that commercial grade vanadium pentoxide (>98% Purity) could be produced from this vanadium concentrate.

ASX:SYR) has the Balama graphite project located down-strike on an extension of Caula mineralisation. In 2014 Syrah Resources (ref Syrah Resources "Update on Vanadium Metallurgy" dated 8 April 2014) reported the results of vanadium recovery testwork on their ore. It was noted that that the application of WHIMS and mica flotation processes to the graphite flotation tailings was effective in recovering vanadium and could achieve a combined concentrate grade of > 3% V2O5. Further work showed that commercial grade vanadium pentoxide (>98% Purity) could be produced from this vanadium concentrate.  New Energy Minerals Ltd (ASX:NXE) (FRA:GGY) is an ASX listed junior mining company, that recently announced the divestment of the Company's Caula vanadium - graphite project and the Montepuez Ruby project in Mozambique.

New Energy Minerals Ltd (ASX:NXE) (FRA:GGY) is an ASX listed junior mining company, that recently announced the divestment of the Company's Caula vanadium - graphite project and the Montepuez Ruby project in Mozambique.