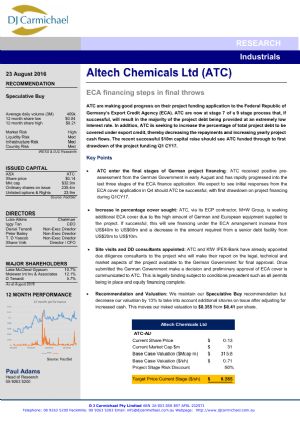

A$20 Million Capital Raising

Perth, July 9, 2018 AEST (ABN Newswire) - Altech Chemicals Limited (Altech/the Company) ( ASX:ATC) (

ASX:ATC) ( A3Y:FRA) is pleased to announce that it has received commitments from a variety of institutional and professional investors for a share placement of ~A$17 million (before costs). Proceeds from the placement will be applied to the commencement of construction at the Company's high purity alumina (HPA) plant site in Johor, Malaysia; to finalise HPA plant engineering; for corporate purposes (including the close of project finance); and working capital.

A3Y:FRA) is pleased to announce that it has received commitments from a variety of institutional and professional investors for a share placement of ~A$17 million (before costs). Proceeds from the placement will be applied to the commencement of construction at the Company's high purity alumina (HPA) plant site in Johor, Malaysia; to finalise HPA plant engineering; for corporate purposes (including the close of project finance); and working capital.

Highlights

- Share placement raises A$17 million

- Share Purchase Plan to raise up to an additional A$3 million

- Funds will be used to commence construction in Johor, Malaysia

- Strong support from a range of institutional and professional investors

Placement shares will be issued at a price of $0.165 per share, representing a 13.2% discount to the price of the Company's shares as traded on the ASX at the close of trade on Wednesday 4 July 2018. The placement shares will be issued pursuant to the pre-approval obtained from shareholders in General Meeting on 12 June 2018. Sydney based Petra Capital Pty Ltd acted as the Sole Lead Manager of the placement.

Share Purchase Plan

The Company is pleased to announce that it will offer a Share Purchase Plan (SPP), whereby existing eligible shareholders will be able to make application to purchase up to $15,000 of new shares at the same price paid by the placement participants. The SPP is expected to raise up to A$3 million and the record date for eligibility to participate is Friday 6 July 2018. Full details of the SPP will be lodged shortly.

Stage 1 Construction - Malaysian HPA plant

The Company expects that stage 1 construction works (approximately A$10m) will commence at its Malaysian HPA plant site during the current quarter. The proposed construction work will include bulk earthworks; extensive foundation piling; the construction of retaining walls, underground storm water/process discharge tanks (OSD tanks); and construction of a maintenance workshop. The maintenance workshop will be used as the construction site offices during stage 2 of the HPA plant construction.

Altech has decided to equity fund stage 1 construction in Malaysia to maintain project momentum; the works will be conducted in parallel with project finance close. The majority of the cost of stage 1 construction will be credited against the US$280 million lump-sum fixed-price HPA plant engineering procurement and construction (EPC) contract awarded to German engineering firm SMS group GmbH (SMS), which is expected to commence following finance close.

Altech managing director, Mr Iggy Tan said, "The Company is extremely pleased with the support that it has received for the share placement. The placement was well supported by existing shareholders and we are delighted to welcome a number of high quality new investors onto the share register.

"The funds that have been raised will allow Altech to commence HPA plant construction in parallel to finalising project financing. The success of any project depends on maintaining development momentum and we have achieved that in the last four years", Mr Tan concluded.

Project Financing

On 2 February 2018 the Company announced that it had executed commitment and final terms for a US$190 million senior debt package with German government-owned KfW IPEX-Bank(see Note below). On 11 May 2018 the Company received an indicative non-binding mezzanine debt term sheet from a global investment bank equal to US$90 million and on 15 June 2018 announced that it had executed an indicative non-binding term sheet for a US$60 million stream finance facility. Combining the streaming facility with senior debt and mezzanine debt would provide total project finance of US$340 million, as summarised in Table 1(see link below), which the Company is considering. The Company also continues to explore potential project-level joint venture options with several major industrial groups that could result in a major reduction of the final equity amount required to fund the project.

Total financing costs, including working capital requirements during construction and the funding of lender mandated reserve accounts, are yet to be finalised and will depend on final lender requirements. Financing costs will include bank fees, arrangement fees, debt service reserve, and other lender defined contingencies and/or reserves. Working capital requirements will include operational funds during construction, commissioning and plant start-up and until the receipt of initial revenue from HPA sales. It not unusual for total financing, contingency and working capital costs to aggregate at up to one third of total capital costs for large scale projects, such as the Company's HPA project.

Note: Draw-down on the senior KfW IPEX-Bank debt is subject to the satisfaction of various conditions precedent, principal of which is securing a balance of funds - refer ASX announcement of 2 February 2018.

To view tables, please visit:

http://abnnewswire.net/lnk/A827HXH2

About Altech Batteries Ltd

Altech Batteries Limited (ASX:ATC) (FRA:A3Y) is a specialty battery technology company that has a joint venture agreement with world leading German battery institute Fraunhofer IKTS ("Fraunhofer") to commercialise the revolutionary CERENERGY(R) Sodium Alumina Solid State (SAS) Battery. CERENERGY(R) batteries are the game-changing alternative to lithium-ion batteries. CERENERGY(R) batteries are fire and explosion-proof; have a life span of more than 15 years and operate in extreme cold and desert climates. The battery technology uses table salt and is lithium-free; cobalt-free; graphite-free; and copper-free, eliminating exposure to critical metal price rises and supply chain concerns.

Altech Batteries Limited (ASX:ATC) (FRA:A3Y) is a specialty battery technology company that has a joint venture agreement with world leading German battery institute Fraunhofer IKTS ("Fraunhofer") to commercialise the revolutionary CERENERGY(R) Sodium Alumina Solid State (SAS) Battery. CERENERGY(R) batteries are the game-changing alternative to lithium-ion batteries. CERENERGY(R) batteries are fire and explosion-proof; have a life span of more than 15 years and operate in extreme cold and desert climates. The battery technology uses table salt and is lithium-free; cobalt-free; graphite-free; and copper-free, eliminating exposure to critical metal price rises and supply chain concerns.

The joint venture is commercialising its CERENERGY(R) battery, with plans to construct a 100MWh production facility on Altech's land in Saxony, Germany. The facility intends to produce CERENERGY(R) battery modules to provide grid storage solutions to the market.

| ||

|