Perth, Sep 21, 2017 AEST (ABN Newswire) - Graphex Mining Ltd ( ASX:GPX) metallurgical test work significantly enhances flake size & drives valuation uplift.

ASX:GPX) metallurgical test work significantly enhances flake size & drives valuation uplift.

Analyst Comment: Metallurgical test work by the Chinese syndicate of investors far exceeded our expectations, as results show 42% of the flake size is equal to or greater than super jumbo (price increases as flake size increases). The significant improvement in flake size has increased our average basket price from US$1,217/t to US$1,876/t (TSI assumption). This was despite keeping our flake graphite pricing assumptions largely unchanged.

We believe these strong metallurgical results also highlight why the Chinese syndicate of investors led by CN Docking, a subsidiary of CNBM (China National Building Materials) who are responsible for producing more than 50% of China's building materials, were so keen to move ahead with the transaction despite recent legislative changes in Tanzania.

Expandable graphite is a primary product in flame retardant building materials and as we previously highlighted, recent changes to Chinese building regulations have mandated the use of flame retardant building materials for all future constructions in China. We believe having guaranteed offtake from a project which is fast becoming one of the worlds leading expandable graphite projects, for their downstream building production, is in our opinion far more important than small changes to the project's ownership structure.

We look forward to the JV between Graphex and the Chinese syndicate becoming binding in the coming months, which should see a significant re-rating in the company's share price.

The information in this email should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

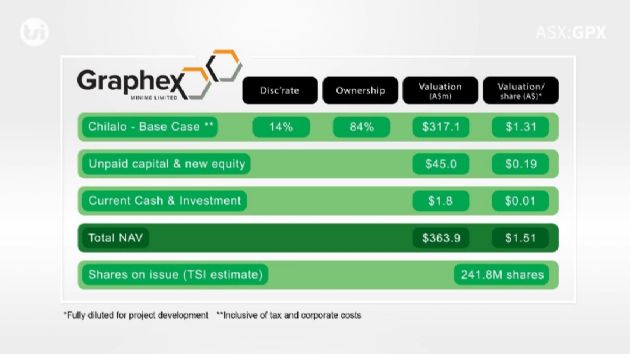

Valuation: We have increased our valuation from $1.40 to $1.90 / share (share price $0.24). The major change in our valuation was updating our flake size distribution in-line with recent test work. And whilst we kept our flake graphite pricing assumptions largely unchanged, the significant improvement in coarse flake graphite material resulted in our basket price increasing from US$1,217/t to US$1,876/t.

Our valuation would have been higher however, we increased our discount rate to 16% (previously 12%) to account for country and JV completion risk. We will review our discount rate assumption once the JV becomes binding.

Finally, we acknowledge there is a significant disconnect between our valuation and Graphex's current share price. One of the major drivers for our valuation per share is the limited future dilution for Graphex shareholders (Future shares on issue - 86m shares vs. current 69m).

As our valuation assumes that the JV proceeds, once the JV partner contribute their equity contribution (US$15 - US$17m) as well as debt financing (JV partner to arrange from China), Graphex's contribution, therefore future capital raising requirement is minimal. Meaning that even minor changes to the projects NPV, can have a significant impact on a valuation per share basis.

To view the video, please visit:

http://www.abnnewswire.net/press/en/90042/gpx

About Graphex Mining Ltd

Graphex Mining Limited (ASX:GPX) is an Australian resources company listed on the Australian Securities Exchange under stock code GPX. Graphex owns the world-class, coarse flake Chilalo Graphite Project, located in south-east Tanzania, which is an outstanding development ready opportunity.

Graphex Mining Limited (ASX:GPX) is an Australian resources company listed on the Australian Securities Exchange under stock code GPX. Graphex owns the world-class, coarse flake Chilalo Graphite Project, located in south-east Tanzania, which is an outstanding development ready opportunity.

About The Sophisticated Investor

The Sophisticated Investor is a new equity investment tool which seeks to assist investors in becoming more informed in their investment decision making. We show and tell investors about a company in a series of short, informative videos. We possess specialist equity analyst skills and are complemented by video professionals. We conduct site visits and interview management, in a way most investors simply aren’t able to access. We promote long term value creation for investors by employing detailed financial analysis and intrinsic value calculations.

Customer notice

Adam Kiley trading as The Sophisticated Investor ('TSI'), (AR No. 458224), is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359). The information contained in this communication is intended as general advice only. Your personal objectives, financial situation and needs have not been taken into consideration. Accordingly, you should consider how appropriate the advice is (or is not) to your objectives, financial situation and needs before acting on the advice. The information in this communication should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Conflict of interest

TSI does and seeks to do business with companies featured in its articles and videos. As a result, investors should be aware that TSI may have a conflict of interest that could affect the objectivity of some articles or videos. Investors should consider TSI articles and videos as only a single factor in making any investment decision. The publishers also wish to disclose that they may hold stock in some companies featured in their articles and videos, and that any decision you make to purchase the stock of a company TSI profiles should be made only after you have initiated your own enquiries as to the validity of any information contained in those articles and videos.

Publisher's note

TSI will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist, we will initiate coverage of that company and follow up with ongoing updates and commentary on its activities. Articles and videos produced and published by TSI are NOT Research Reports in terms of ASIC Regulatory Guide 79.

| ||

|