Matilda Feasibility Confirms 2016 Production

Matilda Feasibility Confirms 2016 Production

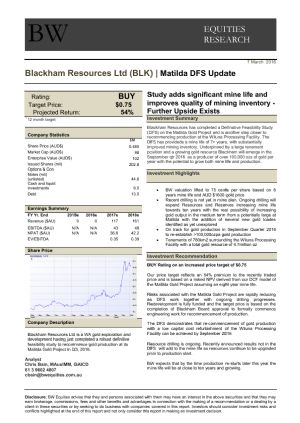

Perth, Feb 24, 2016 AEST (ABN Newswire) - Blackham Resources Ltd ("Blackham" or "the Company") ( ASX:BLK) has pleasure in announcing the completion of the Definitive Feasibility Study ("DFS") on its 100% owned Matilda Gold Project ("Project").

ASX:BLK) has pleasure in announcing the completion of the Definitive Feasibility Study ("DFS") on its 100% owned Matilda Gold Project ("Project").

- Rapid low capital pathway to gold producer within 6 months

- Ore Reserve Estimate of 481,000oz (PFS 270,000oz) demonstrates very high conversion of Mineral Inventory into Reserves

- DFS adds two years of mine life enabling sustainable ongoing production

- Project implementation underway

Blackham Managing Director Bryan Dixon - "The Matilda Gold Project Definitive Feasibility Study has confirmed the robust near term cash flows from the Project enabling us to benefit from the current strong AUD gold price. Matilda is the most capital efficient, nearest term producer and has the shortest payback amongst its Western Australian development peers.

The drill programmes at Matilda and Golden Age are ongoing with the aim of improving the length, quality and sustainability of the mine life. It is an exciting time as Blackham implements its low risk execution plan to become Western Australia's next gold producer."

Summary

The Company is very pleased to have confirmed the Project's robust economics including a low capital requirement, short timeframe to production, fast payback and operating costs that are in line with its Western Australian peers. The very low capex required for the project is due to the substantial plant and infrastructure at site and the minor plant refurbishments required to re-start the project.

The table below demonstrates the projects economics at a range of gold prices. Every A$100/oz increase in the gold price adds $63 million to the cash flow of the project.

Gold Price A$1,500/oz(1) A$1,600/oz(2) A$1,700/oz(3) Sensitivity Project Cash Flow $171 $234 $296NPV7% before corp & tax $121 $170 $219Payback (months) 14 12 9IRR before corp & tax 102% 150% 211%EBITDA (1st 5years average) $52M $62M $72M

1. A$1,500/oz approximates the 5 year average gold price

2. A$1,600/oz approximates the average 2016 YTD gold price

3. A$1,700/oz approximates the average gold price of the last 10 days

During the DFS process, an additional two and half years' has been added to the mine life from the PFS which results in a significant improvement in the Project's economics. The DFS confirmed strong conversion of Inferred Resources into Indicated Resources and PFS Mineral Inventory into Reserves. Since finalising the DFS Resources, Blackham has continued drilling at Matilda, Golden Age and Bulletin with the aim of improving the quality and quantity of the reserve ounces. Further reserve re-estimates are expected prior to production.

Blackham is pleased to report the results of the DFS show improved economics to the PFS (refer ASX announcement 20 October 2015) plus the addition of a longer mine life and a superior confidence level, improving from +/- 25% to +/- 15%. The results of the DFS confirm the mining and processing parameters are not dissimilar to the results of the PFS.

Following the completion of the DFS, Blackham's Board have committed to the Matilda implementation plan and development timeline. The 4.7Moz Matilda Gold Project is targeting production by Q3 2016.

Blackham has a very experienced team in gold exploration, development and operations. The existing plant and infrastructure and the processing of soft Matilda oxides from open pits at the beginning of the mine schedule equates to a low risk start up strategy.

The Company signed a $38.5 Million Funding Facility with Orion Mine Finance on 29 May 2015 ("Orion Funding Facility") with $13 million drawn during 2015. Subject to successful review of the DFS, which is currently being fast tracked, and the granting of the remaining submitted approvals, a further $23 million will be available under the Orion Funding Facility for the development of the Matilda Gold Project.

Resources

Blackham over the last 4 years has consolidated the Wiluna Goldfield and now has a 780km2 exploration tenement package which has historically produced over 4.3 million ounces. The Matilda Gold Project is located in Australia's largest gold belt which stretches from Norseman to Wiluna and passes through Kalgoorlie and Leinster. Blackhams 100% owned Wiluna gold plant, gas power station, camp, borefields and underground infrastructure operated up until 2013, is located in the centre of the Matilda Gold Project. The Matilda Gold Project's 45Mt @ 3.2g/t for 4.7Moz gold Resources are to JORC 2012 standard (see Table 1 in link below) and are all within a 20km radius of the Wiluna Gold Plant.

At least 21Mt @ 3.4g/t for 2.3Moz (49%) are in the Indicated Resource category.

Blackham intends to re-commission the Wiluna Gold Plant on base load free-milling ore from the Matilda Mine followed by the Williamson Mine, which is supplemented with higher grade quartz reef ores from the Golden Age underground and the Galaxy open pit.

The Resources at the Matilda Gold Project have been updated with results of drilling programmes undertaken up until December 2015. Current drilling programmes undertaken at Matilda, Galaxy, Golden Age and Bulletin this year have not been included in the DFS but will be used in a revision of the Resources and Reserves prior to the commencement of production.

Mining and Mining Inventory

Mining at the Matilda Gold Project will be undertaken by mining contractors with management and technical services undertaken by Blackham personnel. The Project will operate as a Fly In, Fly Out (FIFO) operation from Perth with local residents employed where possible. DFS mine designs were completed on the main mining centres at Matilda, Galaxy, Williamson and Wiluna.

Open pit mining is planned for Matilda, Williamson and Galaxy and will all utilise a standard truck and excavator mining technique involving conventional drill, blast, load and haul. Ore will be hauled by road train to the Company's Wiluna gold plant on existing haul roads. In addition to the mining fleet, ancillary plant consisting of tracked bulldozers, wheel loaders, graders and water carts will be required. The ancillary fleet will prepare drill and blast areas, maintain active digging areas, mine roads and waste dumps. Ore will be delivered to the Run of Mine (ROM) pad at the plant site by trucks and then fed to the treatment plant via a ROM loader.

The underground operations at Wiluna have been divided into three distinct areas. The Golden Age and Bulletin undergrounds will be accessed from the existing Bulletin Portal and current Golden Age decline. The East West Underground will also be accessed from existing underground infrastructure and portal access from East Pit. Ore from the underground mines will be predominately extracted via top-down mechanised longhole open stoping and a smaller amount of a bottom-up modified Avoca method using unconsolidated backfill. Suitable pillars are left behind to ensure ground stability during the mining. Ore is trucked to the surface and then hauled to the treatment plant. The majority of the underground ore is in the top 600m and has a relatively short haul to surface.

The DFS Mining Inventory contains 8.3Mt @ 2.9g/t for Production of 668,000oz Au recovered over 7 years and 3 months. The Mineral Inventory under the DFS has grown 203,000oz from the PFS (increase of 44%).

DFS production average is based upon the first 5 years of production. Blackham's aim is to grow the mine life length sufficiently to allow a sustainable ongoing operation through the replacement of production ounces from both the large 4.7Moz resource base and ongoing exploration (see Chart 1 in link below). The Matilda Gold Project has produced over 4.3Moz historically and the Wiluna Plant has operated for 28 of the last 31 years.

Production Schedule

The following charts show the production profile over the initial life of Mine (LOM). Chart 1 displays the production profile of the mining inventory of the operation. The open pit operations are the primary base load source of ore in the first 3 years. The key features of the production schedule are;

- LOM of 7 years 3 months for 8.3Mt @ 2.9g/t for 767,000 ounces of mine production (Chart 1 & 3)

- Estimated average annual production of 101,000ozpa and 668,000oz LOM (Chart 1)

- Base load open pit & stockpile production totals 5.3Mt @ 1.7g/t mined over 3.2 years

- Underground production total of 3.0Mt @ 4.9g/t mined over 6.5 years

Blackham intends to re-commission the Wiluna Gold Plant on free-milling ore from the Matilda and Williamson Mines which provides base load open pit ore of 5.32Mt @ 1.7g/t mined over 3.2 years. The Wiluna Gold Plant has not had a significant base load oxide and free milling open pit feed since the early 1990's. In year 2 the plant throughput peaks at 1.7Mtpa due to the soft nature of the Matilda oxide ore. The open pit stripping ratio is 10.7 to 1 LOM. The open pit mining costs are $5.60/bcm and $2.60/t of material moved.

The Golden Age underground commences prior to re-commissioning of the Wiluna Plant. Golden Age combined with the Galaxy Open pit provides a higher grade free milling quartz reef ore during the first 2 years.

The Bulletin underground commences during year 3 and the East West underground commences at the end of the same year. By the start of year 4 significant Williamson open pit stockpiles are stored to ensure the plant runs at full capacity over the remainder of the LOM.

Table 3 above summarises the respective Mineral Resource Estimation classification (by ounces) that are used in the potential Matilda Gold Project mining inventory. For the 767,000 ounce LOM total, 66% is classified as Measured and Indicated Mineral Resource, and 34% as Inferred Mineral Resource. The DFS mine designs have been used to schedule a production profile for the Matilda Gold Project. The mining inventory associated with the higher confidence Measured and Indicated Mineral Resources are scheduled in the early years of the project (see Chart 2).

The Mining Inventory includes the Matilda, Galaxy, Golden Age and Williamson deposits plus the East/West Lodes. All these deposits except Galaxy have been previously processed through the Wiluna Gold Plant. The open pit resources which are mined in the first 3 years have 93% of the in pit resources now to a Measured and Indicated resource category (see Chart 2 in link below). Over the last 2 months additional infill drilling at Matilda and Galaxy is aimed at further upgrading the resource confidence in these pits. The underground resources, which are processed toward the end of the current mine life, have 50% of all resources in the Indicated category.

Additional infill drill programmes are ongoing at Golden Age and Bulletin since the underground resources were last estimated. Blackham notes that over 97% of the Inferred Resources in the Mineral Inventory are coming from deposits that have a previous mining history, giving further confidence to the grade of these Inferred Resources. The Company also notes the Wiluna goldfield has a long history of converting Inferred Mineral Resources to Indicated Mineral Resources with ongoing drilling. Over the last 14 months from scoping through PFS to DFS Blackham has seen a very high conversion of inferred resources into reserves.

The proportion of Inferred material contained within the mine plan has been reviewed by independent mining consultants Entech Pty Ltd ('Entech') and is considered to be comparable to projects at a DFS level of study. The Company believes there is a reasonable expectation that a material conversion of Inferred Mineral Resources to Indicated Mineral Resources will occur from infill drilling at the Matilda Gold Project as it progresses through to production.

Resources of a further 37Mt @ 3.3g/t for 3.9Moz (49% of which are Indicated Resources) are sitting outside the above Mineral Inventory. Blackham is continuing to review its mining and processing studies with a view to bringing further deposits and resources into the mine life prior to production.

Statement of Reserves Entech was commissioned by Blackham to provide an independent Ore Reserve Estimate update for the Matilda Gold Project as at 23 February 2016. The Ore Reserve Estimate is based on JORC-compliant Mineral Resource Estimates as provided to Entech. The Ore Reserve has been calculated in conjunction with the DFS for the Project and is underpinned by that study. Measured and Indicated Resources have been converted to Proven and Probable Ore Reserves subject to mine design physicals and an economic evaluation. A detailed financial model for the Project was generated by Entech as part of the study process and has been used to determine economic viability of the Ore Reserve Estimate.

Geotechnical Studies Geotechnical assessments were conducted by Peter O'Bryan and Associates on the proposed open pits and underground operations. The Geotechnical worked undertaken involved diamond drilling for core samples, laboratory testing, logging and photogrammetric mapping. The geotechnical analysis is to a suitable level of detail for the DFS and forms the basis of pit wall design criteria, underground stope sizes and pillar designs, underground mining factors, underground development design and support assumptions.

Mining The mining methods chosen are well-known and widely used in the local mining industry and production rates and costings can be predicted with a suitable degree of accuracy. Suitable access exists for all mines with allowances being made for earthworks and infrastructure requirements including haul road refurbishment and clearing for site facilities and mining areas. The Matilda Gold Project's open pits are all within a 20 kilometre radius of the Wiluna Gold Plant with haulage distances for Galaxy, Matilda and Williamson being 15, 18 and 26 kilometres respectively. Current open pit contractor quotes were obtained for optimisation and cost estimations on each of the mining areas. Optimum pit shells were selected for detailed open pit designs.

Underground Underground production at East-West and Golden Age will be mined top-down via mechanised longhole open stoping with in-situ pillars retained for stability. The Bulletin upper and mid will be longhole open stoping also and the Bulletin 200 and Creekshear will utilise a bottom-up modified Avoca method using unconsolidated backfill. Diesel powered trucks and loaders will be used for materials handling. Diesel-electric jumbo drill rigs will be used for development and ground support installation. Details of the design criteria and mine design parameters are outlined in Section 4 of Appendix 2. The underground mining operating costs are $68/t of ore plus $21/t of ore for sustaining capital.

Gold Ore Processing

The Wiluna Gold Plant has run under several incarnations in the last three decades of operation including Carbon in Pulp (CIP), Carbon in Leach (CIL) and more recently as a BIOX(R) CIL allowing it to process refractory, (sulphide) ore with a smaller oxide (free milling) circuit.

Blackham's plan is to optimise existing plant components and upgrade the free milling oxide CIP plant to process current resources. The DFS metallurgical testwork program was designed to optimise the existing plant and where necessary, upgrade components accordingly.

As part of the DFS, metallurgical testing of Matilda, Golden Age, Galaxy, Williamson and Wiluna ores was completed to determine the ore characteristics with respect to:

- Process applicability to the Wiluna Gold Plant

- Overall gold recovery

- Processing properties

- Ability to blend different ore sources

The testwork programs included:

- Comminution

- Gravity

- XRD Mineralogy

- Leaching and reagent consumptions

- Thickening and rheology

The testwork and optimisation results showed the overall metallurgical performance achievable from Matilda will be 93% gold recovery, Williamson 95%, Golden Age 90% and Galaxy 94% for a weighted average of 93%. The testwork also indicated overall recovery would be improved in most ores through the addition of a gravity circuit. The testwork also showed leach times may be reduced with the intensive oxygenation which will also result in a reduction of reagent costs and reduced stripping costs through higher carbon loadings.

To view the full report, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-BLK-753697.pdf

About Wiluna Mining Corporation Ltd

Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.

Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:BLK) has pleasure in announcing the completion of the Definitive Feasibility Study ("DFS") on its 100% owned Matilda Gold Project ("Project").

ASX:BLK) has pleasure in announcing the completion of the Definitive Feasibility Study ("DFS") on its 100% owned Matilda Gold Project ("Project").  Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.

Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.