HPA Demand Growth Tied to Lithium-Ion Batteries

Perth, Feb 23, 2016 AEST (ABN Newswire) - Altech Chemicals Limited (Altech/the Company) ( ASX:ATC) is pleased to provide further information on the fast growing utilisation of high purity alumina (HPA) in lithium-ion batteries. Altech recently appointed Mr Martin Ma as the Company's sales and marketing manager in China. Mr Ma has already commenced discussions with lithium-ion battery manufacturers in China where there is considerable interest for Altech's HPA product.

ASX:ATC) is pleased to provide further information on the fast growing utilisation of high purity alumina (HPA) in lithium-ion batteries. Altech recently appointed Mr Martin Ma as the Company's sales and marketing manager in China. Mr Ma has already commenced discussions with lithium-ion battery manufacturers in China where there is considerable interest for Altech's HPA product.

Highlights

- Fast-emerging use of HPA in lithium-ion batteries for electric vehicles (EVs)

- HPA use in lithium-ion battery separators is in the region of 120g per kWh

- HPA increases discharge rates; lowers self-discharge; and lengthens life-cycles

- HPA increases the separator's shrinkage temperature and reduces flammability during thermal runaways

- Altech forecasts HPA demand for lithium-ion battery separators at about 3,936tpa (China only) by 2020

- This market segment alone can potentially absorb all of the production from Altech's proposed 4,000tpa Malaysian HPA plant

The use of HPA embedded in large format lithium-ion battery separators is growing very rapidly. HPA is used to increase the battery's discharge rates; lower self-discharge; and lengthen life-cycles. It is also used to increase the separator shrinkage temperature and reduce flammability during thermal runaways. Lithium-ion battery producers are reporting battery usage of ~120g of HPA per kilowatt-hour (kWh).

Based on the information gathered by Mr Ma, combined with published Chinese government data about its targeted growth in electric powered vehicles (EV's), Altech has forecast potential HPA use by Chinese lithium-ion battery manufactures which is presented in Graph 1. The graph shows a low, middle and high forecast of usage. In the middle case, HPA demand is forecast at about 3,936 tonnes per annum (tpa) by 2020, which is roughly the annual production capacity of Altech's proposed Malaysian HPA plant.

The forecast demand is only for China and does not take into account Korea (currently the world's 2nd largest lithium-ion battery manufacturer), Japan (3rd largest), Taiwan, or Tesla's planned "Gigafactory" in the USA. Altech will be targeting the Chinese lithium-ion battery manufacturers for its first stage of HPA sales and off-take agreements.

Lithium-ion Battery Market

The global push for electric vehicles and energy storage is becoming an increasing market trend for lithium-ion batteries. Today, the large-scale adoption of EVs is still nascent; however, adoption is forecast to grow strongly. In support of accelerating EV adoption worldwide, government ownership policies and initiatives are being implemented such as the International Energy Agency's (IEA) Electric Vehicles Initiative (EVI), which aims to have 20 million EV's (including hybrid vehicles) on the road by 2020. Also, while not yet a large demand driver, growth in lithium-ion battery demand from the electricity storage (solar energy) market is expected to exceed 30% pa.

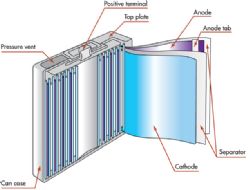

Separator Background

As the use of rechargeable lithium-ion batteries for high-power electronics applications is becoming increasingly widespread, the battery's safety and reliability is now of paramount importance. One of the battery's most critically important components to ensure cell safety is the separator (See Figure 1 in link below), which is a thin porous membrane that physically separates the battery's anode and cathode. The primary function of the separator is to prevent physical contact between the anode and cathode, while facilitating ion transport within the cell.

The most commercially available, non-aqueous lithium-ion separators are single layer or multilayer polymer sheets typically made of polyolefin. Most commonly, these are polyethylene (PE) or polypropylene (PP), which have transition temperatures of 135°C and 165°C. Separators are typically manufactured by either an extrusion process (wet or dry) followed by a mechanical stretching process to induce porosity; or, from wet-laid fibres to make nonwoven mats. Many of the multilayer separators are designed with a shutdown feature where two of the layers have different phase transition temperatures. As the temperature of a cell increases, the lower melting component melts and fills the pores of the other solid layer and stops ion transport and current flow in the cell.

In general, there is a migration toward the production of large format lithium-ion batteries (capacity >10Ah) for transportation and utility storage. With these larger format batteries, a fast growing method to improve the thermal and mechanical stability of lithium-ion separators is to use HPA or ceramic composite-base materials. These composite separators are multilayer films where the HPA layer is supported on one or both sides of a polymer membrane substrate. HPA-embedded separators (composite separators) have better wettability and ionic conductivity than a commercial PE separator by a factor of two (2). In addition, the HPA-coated separators have less shrinkage compared to PE separators at temperature. HPA is an excellent fire retardant and reduces separator combustion during thermal runaway.

Tesla's $5B Gigafactory

Tesla's entry into the lithium-ion market will undoubtedly impact demand. The American automotive and energy storage company is establishing a lithium-ion battery factory, called the "Gigafactory", which is located at the Tahoe Reno Industrial Centre in Storey County, Nevada, USA, and slated to be operational by 2017. The projected cost to build the facility was approximately US$5 billion. Tesla announced it will be building 500,000 electric cars per year by 2020 and hitting a scale that will drive down the cost of its 60 kilowatt-hour battery pack by 30% to about $10,000. The project aims to disrupt battery costs to impact the distributed storage industry. Tesla's Gigafactory will sprawl across 500 to 1,000 acres of land situated near highways and rail, with space for a few hundred megawatts of solar panels and some wind turbines.

To view figures, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-ATC-753546.pdf

About Altech Batteries Ltd

Altech Batteries Limited (ASX:ATC) (FRA:A3Y) is a specialty battery technology company that has a joint venture agreement with world leading German battery institute Fraunhofer IKTS ("Fraunhofer") to commercialise the revolutionary CERENERGY(R) Sodium Alumina Solid State (SAS) Battery. CERENERGY(R) batteries are the game-changing alternative to lithium-ion batteries. CERENERGY(R) batteries are fire and explosion-proof; have a life span of more than 15 years and operate in extreme cold and desert climates. The battery technology uses table salt and is lithium-free; cobalt-free; graphite-free; and copper-free, eliminating exposure to critical metal price rises and supply chain concerns.

Altech Batteries Limited (ASX:ATC) (FRA:A3Y) is a specialty battery technology company that has a joint venture agreement with world leading German battery institute Fraunhofer IKTS ("Fraunhofer") to commercialise the revolutionary CERENERGY(R) Sodium Alumina Solid State (SAS) Battery. CERENERGY(R) batteries are the game-changing alternative to lithium-ion batteries. CERENERGY(R) batteries are fire and explosion-proof; have a life span of more than 15 years and operate in extreme cold and desert climates. The battery technology uses table salt and is lithium-free; cobalt-free; graphite-free; and copper-free, eliminating exposure to critical metal price rises and supply chain concerns.

The joint venture is commercialising its CERENERGY(R) battery, with plans to construct a 100MWh production facility on Altech's land in Saxony, Germany. The facility intends to produce CERENERGY(R) battery modules to provide grid storage solutions to the market.

| ||

|