Quarterly Activities Report

Perth, Oct 30, 2014 AEST (ABN Newswire) - Taruga Gold Limited ( ASX:TAR) (Taruga or the Company) is pleased to present its quarterly activities report for the September quarter. Subsequent to the quarter, Taruga announced an impending aircore drilling program within its Nangalasso and SLAM Project areas in Southern Mali.

ASX:TAR) (Taruga or the Company) is pleased to present its quarterly activities report for the September quarter. Subsequent to the quarter, Taruga announced an impending aircore drilling program within its Nangalasso and SLAM Project areas in Southern Mali.

The program has been initiated following a successful capital raising (see below) and is designed to follow up and test a number of high-grade gold mineralised results (including 3m @ 7.84gpt Au) from previous exploration campaigns and exploration beneath extensive artisanal workings. Nangalasso and SLAM both have an extensive strike length of geochemical anomalism, but with very limited drill testing to date.

NANGALASSO Priority Drilling Targets

The Nangalasso Project is located in a highly mineralised area. The Company's concessions are located just 15km from the world-class Syama gold mine, as well as being located along strike from the Tengrela prospect delineated by Perseus Mining Limited. The Nangalasso Project has returned highly encouraging results from initial geochemical sampling, as well as the wide-spaced reconnaissance drilling, and this current program is planned to test four priority target areas:

1. Follow up of reconnaissance drilling that has returned 3m at 7.84g/t gold in drill hole NAAC021, including 1m at 13.5g/t gold from 16m and 1m at 7.8g/t gold in drill hole NAAC004.

2. Follow up of January 2014 reconnaissance trench sampling of 7m at 4.3g/t gold, located 200m north of previous drilling, an area with an extensive corresponding geochemical anomaly and artisanal workings.

3. Initial testing of artisanal workings that have been mining high grade quartz lode. Workings extend for over 700m with shafts reaching depths over 15m. This new target area is associated with a strong geochemical anomaly and excellent geological setting.

4. Testing of extensive surface workings - Field reconnaissance highlights 1,000m x 700m extensive area of artisanal workings returning assay values up to 18.0g/t, 3.6g/t and 3.54g/t gold in March 2014. No previous drill testing has targeted this exciting area and the potential for primary mineralisation underlying the surface anomalism is high.

SLAM Project Drill Program

In addition to the above works to take place at Nangalasso, the Company also announced its intention to conduct a modest drilling program at SLAM. This program will target a geochemical anomaly with peak values over 2g/t gold, and a major artisanal working that extends for over 700m and is now extracting from primary rock.

COTE D'IVOIRE Geochemical Sampling

Taruga has an extensive landholding in the highly prospective, yet underexplored, Birimian geological sequence of Cote d'Ivoire. The Company has commenced geochemical sampling and geological mapping and reconnaissance of the early stage concessions.

The Company completed its initial review of the concessions and will target several key areas to focus the geochemical sampling in zones of geological interest, as well as artisanal mining, identified by early geological reconnaissance. The geochemical sampling program is expected to continue for the field season and will define targets for first-pass reconnaissance drill testing.

CORPORATE

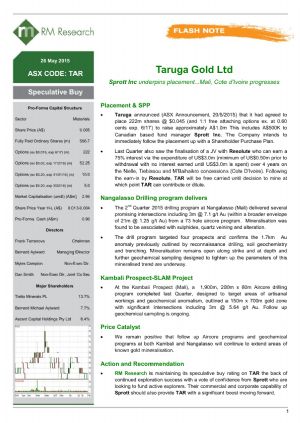

Capital Raising Totals $992,000

During the quarter, Taruga announced a placement to sophisticated and institutional investors to raise $925,000 at an issue price of $0.005 together with free attaching options (on a 1 for 4 basis) exercisable at $0.02 on or before 1 December 2016 (Placement). In conjunction with the Placement, the Company also completed a Share Purchase Plan (SPP) during the quarter to raise an additional $67,000 before costs at an issue price of $0.0053 per share.

The Placement was conducted in two tranches. Tranche 1 comprised 40,000,000 shares and was issued during the quarter pursuant to the Company's placement capacity. Tranche 2 comprised an additional 145,000,000 shares which were issued subsequent to the quarter. Both tranches were approved by Shareholders at a General Meeting of the Company held on 26 September 2014.

Funds raised will be used to accelerate the ongoing exploration campaign in Mali and Cote d'Ivoire detailed earlier in the report.

Board Appointments

During the quarter, the Company announced the appointments of Mr Myles Campion and Mr Daniel Smith as Non-executive Directors of the Company.

Mr Campion is a geologist with a BSc.(Hons.) from University of Wales College Cardiff and a MSc.(MinEx) from the Royal School of Mines in London and is an Associate of the Royal School of Mines. Mr Campion has over 24 years' experience in the natural resources sector, including Resource analyst, Fund Manager, equities research and project and debt financing. Mr Campion has spent over 10 years as a field geologist that includes success at the Emily Ann Nickel Sulphide Mine.

Mr Smith is a member of the Governance Institute of Australia with a strong background in finance. His previous career was in the securities industry but more recently in a corporate finance role inclusive of negotiations, technical due diligence and business development. He has primary and secondary capital markets expertise, having been involved in a number of IPOs and capital raisings.

He is currently a director of ASX listed Fraser Range Metals Group Limited and Minerals Corporation Limited. He is also a director of Minerva Corporate, a private corporate consulting firm.

Mr Smith and Mr Samuel Edis were appointed as Joint Company Secretaries during the quarter. Mr Edis trained at the College of Law in Bloomsbury, London and is an Associate Member of the Governance Institute of Australia. He has experience with a number of ASX-listed companies facilitating compliance, capital raisings, IPOs and investor relations.

The Company's previous CFO and Company Secretary, Mr Peter Newcomb, resigned during the quarter to focus on other corporate responsibilities. Mr Newcomb was a founding Director of Taruga and was instrumental in the completion of the Company's IPO in February 2012. The Board thanks him for his contribution to the Company and wises him every success for the future.

To view the quarterly report, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-TAR-697503.pdf

Contact

Bernard Aylward

Managing Director

Taruga Gold Limited

Mob: +61 418 943 345

| ||

|