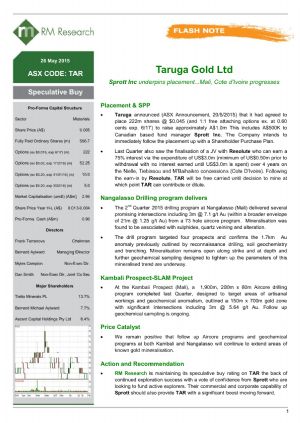

Placement and SPP for West African Gold Exploration

Perth, Aug 27, 2014 AEST (ABN Newswire) - Taruga Gold Limited ["Taruga or "the Company") ( ASX:TAR) is pleased to announce that it is completing a Placement to sophisticated and institutional investors to raise approximately $925,000 (Placement) and in addition is offering a share purchase plan to eligible shareholders to raise approximately $320,000 (Share Purchase Plan).

ASX:TAR) is pleased to announce that it is completing a Placement to sophisticated and institutional investors to raise approximately $925,000 (Placement) and in addition is offering a share purchase plan to eligible shareholders to raise approximately $320,000 (Share Purchase Plan).

The use of proceed will be applied to accelerate a drilling programs at it's highly prospective projects in Mali as well as undertake geochemical sampling within its granted Cote d'Ivoire projects.

In addition to the capital raising, the Company has appointed Mr Myles Campion and Mr Dan Smith as Non-Executive Directors and has appointed Mr Dan Smith and Mr Sam Edis as Joint Company Secretary.

Managing Director Bernard Aylward stated, "Taruga received strong support from existing and new shareholders for this placement and it is a strong reflection of the quality of our West African gold projects. Taruga has an exciting array of projects located within the highly mineralised Birimian sequence in Mali, Cote d'Ivoire and Niger. Our first target for drilling this field season will be the Nangalasso Project located in southern Mali, where regional aircore drilling and trench sampling has returned high grade gold mineralisation".

EXPLORATION CAMPAIGN

Mali

Nangalasso Project - reconnaissance drilling will target key prospect areas within this highly anomalous project area:

- Drilling to follow-up high grade gold intersections from regional drilling that currently remain open along strike and depth

- Drilling designed as first pass test of the extensive artisanal workings and high grade surface geochemical samples.

- Drill testing of geological structures identified by surface mapping, geochemical sampling and trench sampling that has outlined an extensive structure of high grade gold anomalism

Taruga will be continuing the geological and geochemical exploration of this highly prospective project to identify additional high priority targets for ongoing drill testing.

SLAM Project - reconnaissance drilling will target extensive artisanal workings and strong geochemical anomalies as a first pass test of this exciting project area. Taruga acquired the project from Newmont in October 2013 and has completed an extensive review and analysis of geochemical sampling as well as undertaken field mapping and verification. A number of priority targets have been identified and a drilling program has been prepared to commence testing of this project.

Cote d'Ivoire

Taruga has commenced geological mapping, interpretation and geochemical sampling of it's granted licences in Cote d'Ivoire. An exploration program of surface geochemical sampling has been prepared to rapidly advance these projects to define the potential for significant gold mineralisation to be defined and prepare key target areas for initial drill testing.

BOARD APPOINTMENTS

The Company is pleased to announce the appointments of Mr Myles Campion and Mr Dan Smith as Non-Executive Directors of the Company, and in addition the appointment of Mr Dan Smith and Mr Sam Edis as Joint Company Secretary.

Mr Campion is a geologist with a BSc.(Hons.) from University of Wales College Cardiff and a MSc.(MinEx) from the Royal School of Mines in London and is an Associate of the Royal School of Mines. Mr Campion has also completed a Graduate Diploma of Business (Finance). Mr Campion has over 24 years experience in the natural resources sector, including Resource analyst, Fund Manager, equities research and project and debt financing. Mr Campion has over 10 years as a field geologist that includes success at the Emily Ann Nickel Sulphide Mine.

Mr Smith is a member of the Governance Institute of Australia with a strong background in finance. Mr Smith's previous career was in the securities industry but more recently in a corporate finance role inclusive of negotiations, technical due diligence and business development.

Mr Smith has primary and secondary capital markets expertise, having been involved in a number of IPOs and capital raisings. Mr Smith is currently a director of ASX listed Fraser Range Metals Group Limited and Minerals Corporation Limited and is also a director of Minerva Corporate, a private corporate consulting firm.

Mr Edis trained at the College of Law in Bloomsbury, London and is an Associate of the Governance Institute of Australia. Sam currently works with a number of ASX-listed companies facilitating compliance and capital raisings, IPOs and investor relations.

The Company is also announcing the resignation of Mr Peter Newcomb as CFO and Company Secretary who will be focusing on his other corporate responsibilities. Mr Newcomb was a founding Director of Taruga and was instrumental in the successful completion of the Taruga IPO in February 2012. The Company extends its thanks to Mr Newcomb and wishes him well on his future activities.

CAPITAL RAISING DETAILS

Use of Funds

The funds raised from the Placement and Share Purchase Plan will be primarily used to conduct a drilling campaign on the Company's West Africa projects (Drilling Campaign), and otherwise for working capital purposes, as follows

(i) Conduct drilling campaign at Company's projects in Mali, and

(ii) Undertake geochemical sampling and exploration work at Company's granted projects in Cote d'Ivoire, and

(iii) Working capital for requirements of Company's projects in West Africa.

Placements

The Company intends to raise approximately $925,000 pursuant to a placement which is to be conducted in two tranches, as follows:

- Tranche 1: 40 million shares at an issue price of 0.5 cents each (to raise $200,000) have been issued to sophisticated, professional and institutional investors under the Company's existing placement capacity under ASX Listing Rules 7.1 and 7.1A.

- Tranche 2: Subject to all necessary shareholder and regulatory approvals, approximately 145 million shares (to raise approximately $725,000) will be issued to further sophisticated, professional and institutional investors (which may related parties). The Company also intends to issue 46.25 million free attaching options in respect of Tranche 2. The options will be exercisable at 2 cents on or before 1 December 2016. The Company intends to convene a meeting of shareholders as soon as practicable to obtain shareholder approval for Tranche 2 of the Placement.

Share Purchase Plan

The Company is also pleased to announce that it will allow each eligible shareholder to participate in a Share Purchase Plan ("SPP") by purchasing up to $15,000 worth of ordinary shares at $0.0053 per share. The SPP issue price of $0.0053 represents a 24% discount to the last traded price of the Company's shares. The Company intends to raise up to $320,000 pursuant to the Share Purchase Plan.

Shareholders will have the opportunity to subscribe for shares in the following parcels:

--------------------------------------------------Parcel Subscription Value No. Shares Acquired--------------------------------------------------Offer A: $2,000 377,358Offer B: $5,000 943,396Offer C: $10,000 1,886,792Offer D: $15,000 2,830,188--------------------------------------------------

The Share Purchase Plan will allow smaller shareholders the opportunity to increase their investment in the company at an attractive price, being a similar offer price as the Placement. The price that the SPP is offered at is controlled by the ASX Listing Rules.

The ASX Listing Rules provide that the issue price of shares under the SPP must be at least 80% of the average market price for the Company's shares over the last 5 days on which sales were recorded.

The offer under the SPP will open on 28 August and will close on 25 September. Eligible shareholders are those who are registered holders of share in the Company at 5:00pm (WST) on 26 August 2014. The above dates are indicative only and are subject to change at the Company's discretion. The Company reserves the right to scale back the offer, accept oversubscriptions, or close the offer early.

Full details of the SPP, including an indicative timetable and the Plan's terms and conditions will be provided shortly in a subsequent announcement.

Contact

Bernard Aylward

Managing Director

Taruga Gold Limited

Mob:+61 418 943 345

| ||

|