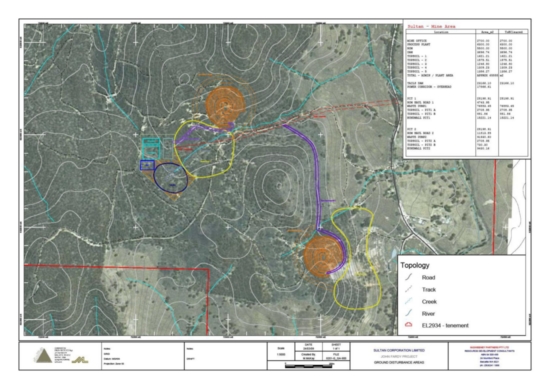

Location plan - John Fardy and Peelwood Open Pits, Waste Dumps and Tailings.

Perth, April 29, 2009 AEST (ABN Newswire) - Sultan Corporation Limited (ASX:SSC)(PINK:SSCSF) announce in the previous quarter a combined total John Fardy and Peelwood resource of 895,000 tonnes at 8.0% zinc equivalent was obtained. Optimization carried by Intermine Engineering Consultants indicate that respective open pits contain a combined resource of 469,000 tonnes at 5.16% zinc, 0.90% copper, 1.17% lead and 20 g/t silver are likely to occur within the respective open cuts at John Fardy and Peelwood projects.

Metallurgical Test work has been undertaken by AMMTEC Limited based in Balcatta, Western Australia. Test work has only been undertaken on John Fardy's mineralisation. An overall summary report was received during the quarter and results indicate that sulphide minerals are readily liberated at both 75 and the coarser 106 micron. Grind recoveries of zinc, copper and lead are all well in excess of 90% and generally greater than 95%. Finer grinding is not required to enhancer flotation. Some additional work will be required to establish the optimum compositions of the final concentrates.

McSweeney Partners Pty Ltd has been engaged to conduct engineering design and a costing study based on a 120-150 ktpa treatment plant. A preliminary site plan design was produced during the quarter, including the location of two open pits, waste dumps and tailings dam.

Initial flora and fauna assessments were completed and reports are being compiled.

On March 20th the directors announced that 48 million shares were allotted pursuant to an application for Shortfall shares. This relates to the Prospectus lodged with the ASX on 18 November 2008 that closed on 23rd December 2008. The total shares issued were 97,518,660 and total funds received were A$487,593.

Chamaguel Phosphate deposit in Mali - Sultan announced on 30th January that it had entered into an agreement to acquire the Chamaguel Phosphate deposit in Mali but that this was subject to due diligence and shareholder and regulatory approval. On 19th March Sultan announced that the agreement had been terminated.

Sultan continues to look for acquisition opportunities as it pursues its growth strategy.

JOHN FARDY AND PEELWOOD RESOURCE ESTIMATES

John Fardy and Peelwood zinc and copper prospects are 100% owned by Sultan Corporation and are located 75km south of Bathurst in central New South Wales. These prospects are part of a larger contiguous group of tenements held by Sultan and include other advanced targets such as Black Springs.

During the previous quarter Sultan produced a resource upgrade at John Fardy based on drilling completed during 2008. A combined total resource of 895,000 tonnes at 8.0% zinc equivalent was obtained for John Fardy and Peelwood.

JOHN FARDY AND PEELWOOD PRELIMINARY MINE OPTIMISATION

Also during the previous quarter Intermine Engineering Consultants carried out optimization of the current resource. Preliminary indications indicate that approximately 469,000 tonnes at 5.16% zinc, 0.90% copper, 1.17% lead and 20 g/t silver are likely to occur within the respective open cuts at John Fardy and Peelwood projects.

Intermine has completed preliminary mine designs for both John Fardy and Peelwood and continue to manage the processes necessary to obtain regulatory approvals required to commence mining operations at both prospects. The preliminary mine design forms the basis for the scoping study currently underway.

METALLURGICAL TESTWORK

Sultan engaged Metallurgical Design to establish recovery characteristics of zinc, copper, lead and silver minerals at John Fardy. Metallurgical Design has also been responsible for optimising plant configuration for mineralisation treatment.

AMMTEC was subcontracted by Metallurgical Design to conduct metallurgical test work of the John Fardy mineralisation. A final compilation report was received during the quarter and the major findings are: -

- Sulphide minerals are readily liberated at both 75 micron and 106 micron;

- Grind recoveries of zinc, copper and lead are all well in excess of 90% and generally more than 95%;

- Finer grinding did not enhance floatation performance; and

- Very good Flotation Bulk Concentrate Recovery = 43.5%. Additional work will be required to determine optimum compositions of the concentrates.

MINING SCOPING STUDY

Sultan has engaged McSweeney Partners Pty Ltd to conduct engineering design and a costing study based on a 120-150ktpa treatment plant. Preliminary assessment suggests the capital costs would fall within the expected values.

A preliminary site layout with the location of two open pits, waste dumps and tailings dam has been produced.

Preliminary flora and fauna assessments have been completed and reports are awaited to determine if further more detailed surveys are required. Reports for both the flora and fauna assessments are currently being prepared.

Biodiversity Monitoring Services of Oberon, N.S.W have undertaken a desktop review of fauna in the general area of the John Fardy project deposits to determine the need to undertake further work, including field assessment.

A flora assessment has been undertaken by Gingra Ecological Surveys of Canterbury, N.S.W. The flora assessment involved a review of literature relating to vegetation of the Peelwood area, access of relevant data bases and a field survey over three days.

The assessment is intended to address necessary requirements of the NSW Environmental Planning and Assessment, the NSW Threatened Species Conservation Act, the NSW Native Vegetation Act and the Commonwealth Environment Protection and Biodiversity Conservation (EPBC).

CORPORATE

On March 20th the directors announced that 48 million shares were allotted pursuant to an application for Shortfall shares. These additional allotted shares relate to a provision for Shortfall shares that was outlined in the Prospectus lodged with the ASX on 18 November 2008.

The prospectus closed on 23rd December 2008 and there was a further three month period in which applications could be made for any Shortfall shares. The total shares issued were 97,518,660 and total funds received were A$487,593.

CHAMAGUEL PHOSPHATE DEPOSIT

Sultan announced on 30th January that it had entered into an agreement to acquire the Chamaguel Phosphate deposit in Mali but that this was subject to due diligence and shareholder and regulatory approval. On 19th March Sultan announced that the agreement had been terminated.

Sultan continues to look for acquisition opportunities as it pursues its growth strategy.

For the Complete Sultan Corporation Quarterly Report, please see the link below;

http://www.abnnewswire.net/media/en/docs/60547-ASX-SSC-444647.pdf

Contact

Derek Lenartowicz

Managing Director

Tel: +61-8-6365-4519

| ||

|